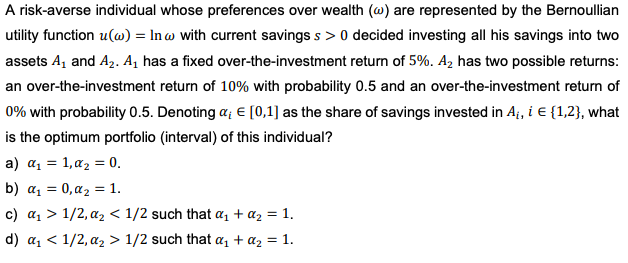

Question: A risk-averse individual whose preferences over wealth (@) are represented by the Bernoullian utility function u(@) = In w with current savings s > 0

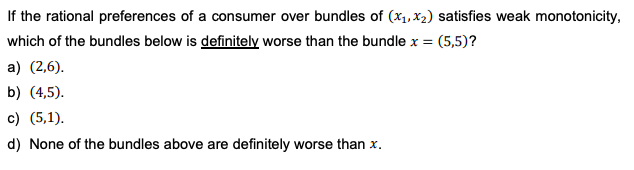

A risk-averse individual whose preferences over wealth (@) are represented by the Bernoullian utility function u(@) = In w with current savings s > 0 decided investing all his savings into two assets A, and A2. A, has a fixed over-the-investment return of 5%. A2 has two possible returns: an over-the-investment return of 10% with probability 0.5 and an over-the-investment return of 0% with probability 0.5. Denoting a E [0,1] as the share of savings invested in A;, i c {1,2), what is the optimum portfolio (interval) of this individual? a) a1 = 1,a2 =0. b) a1 = 0,a2 = 1. c) a, > 1/2, a2 1/2 such that a, + 02 = 1.If the rational preferences of a consumer over bundles of (x1, x2) satisfies weak monotonicity, which of the bundles below is definitely worse than the bundle x = (5,5)? a) (2,6). b) (4,5). c) (5,1). d) None of the bundles above are definitely worse than x

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts