Question: A second version of the Markowitz portfolio model maximizes expected return subject to a constraint that the variance of the portfolio must be less than

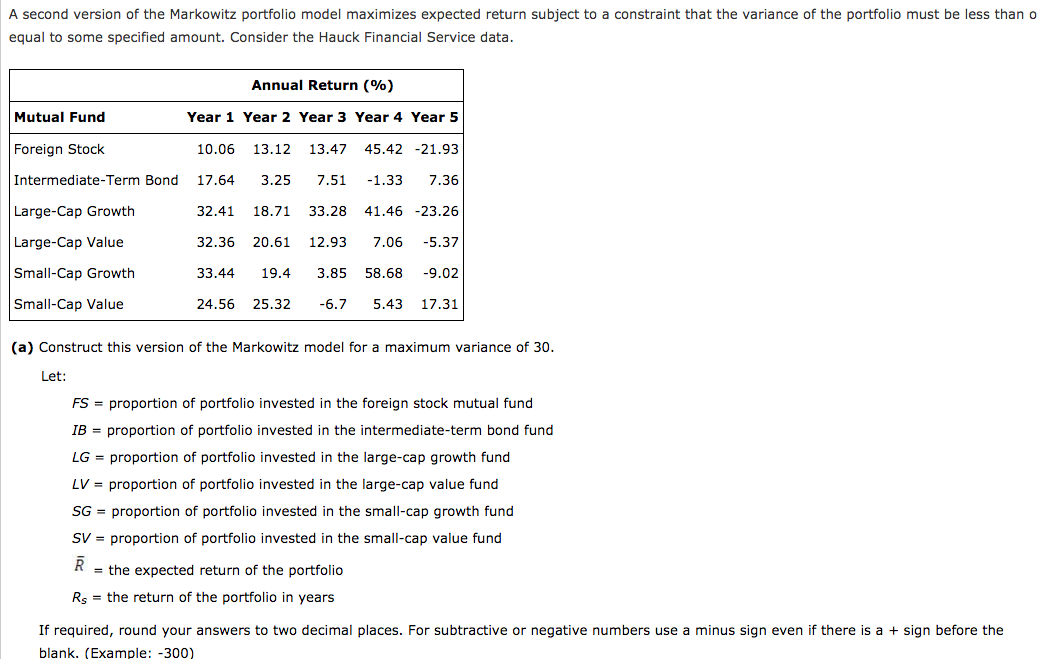

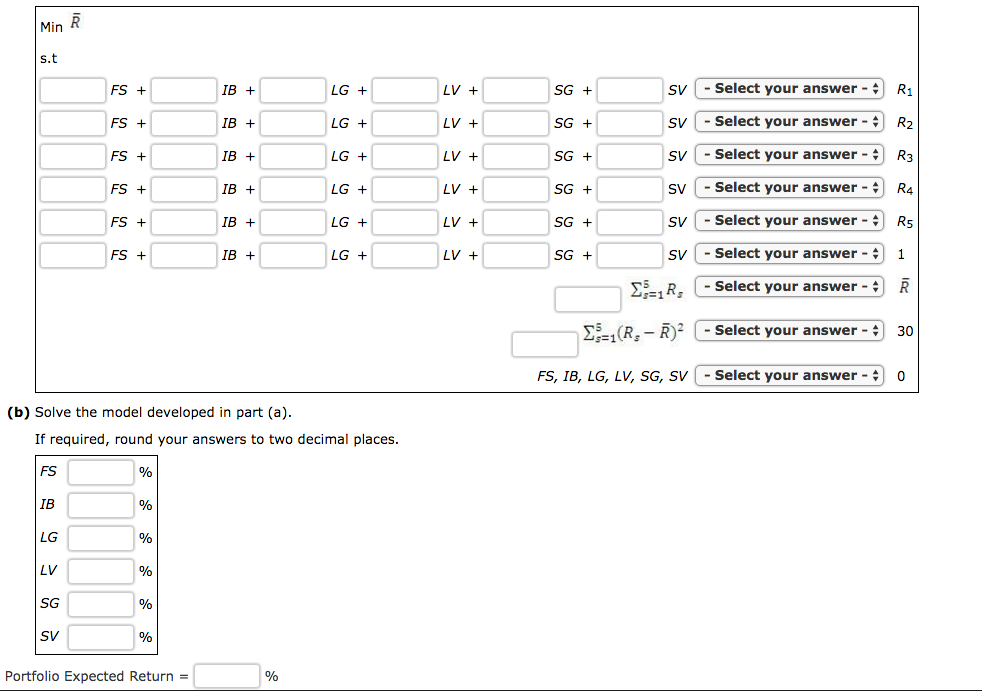

A second version of the Markowitz portfolio model maximizes expected return subject to a constraint that the variance of the portfolio must be less than o equal to some specified amount. Consider the Hauck Financial Service data Annual Return (%) Mutual Fund Foreign Stock Intermediate-Term Bond 17.64 3.25 7.51 -1.337.36 Large-Cap Growth Large-Cap Value Small-Cap Growth Small-Cap Value (a) Construct this version of the Markowitz model for a maximum variance of 30 Year 1 Year 2 Year 3 Year 4 Year 5 10.06 13.12 13.4745.42 -21.93 32.41 18.7133.2841.46-23.26 32.36 20.61 12.93 7.06-5.3.7 33.4419.4 3.85 58.68 9.02 24.56 25.32 -6.75.43 17.31 Let: FS = proportion of portfolio invested in the foreign stock mutual fund proportion of portfolio invested in the intermediate-term bond fund LG = proportion of portfolio invested in the large-cap growth fund LV-proportion of portfolio invested in the large-cap value fund SG proportion of portfolio invested in the small-cap growth fund SV-proportion of portfolio invested in the small-cap value fund the expected return of the portfolio Rs- the return of the portfolio in years If required, round your answers to two decimal places. For subtractive or negative numbers use a minus sign even if there is a + sign before the blank. (Example: -300)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts