Question: A second version of the Markowitz portfolio model maximizes expected return subject to a constraint that the variance of the portfolio must be less than

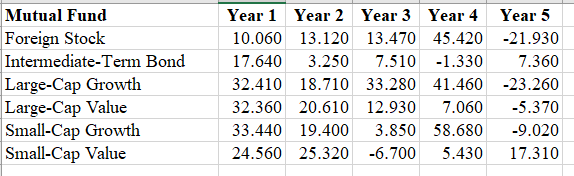

A second version of the Markowitz portfolio model maximizes expected return subject to a constraint that the variance of the portfolio must be less than or equal to some specified amount. Consider the Hauck Financial Service data.

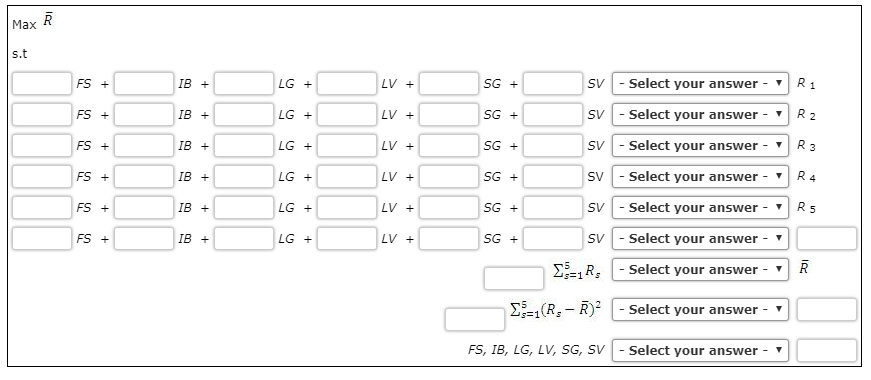

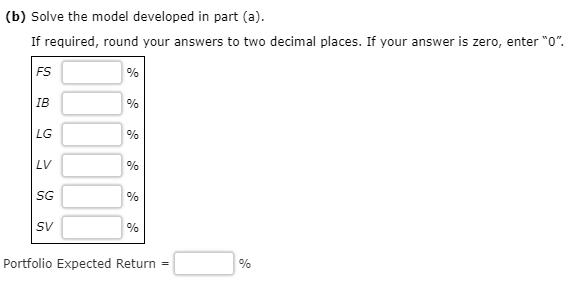

| (a) | Construct this version of the Markowitz model for a maximum variance of 30. | ||||||||||||||||||

| |||||||||||||||||||

| If required, round your answers to two decimal places. For subtractive or negative numbers use a minus sign even if there is a + sign before the blank. (Example: -300) If the constant is "1" it must be entered in the box. If your answer is zero enter 0. |

Mutual Fund Foreign Stock Intermediate-Term Bond Large-Cap Growth Large-Cap Value Small-Cap Growth Small-Cap Value Year 1 10.060 17.640 32.410 32.360 33.440 24.560 Year 2 13.120 3.250 18.710 20.610 19.400 25.320 Year 3 Year 4 13.470 45.420 7.510 -1.330 33.280 41.460 12.930 7.060 3.850 58.680 -6.700 .430 Year 5 -21.930 7.360 -23.260 -5.370 -9.020 17.310 Max R s.t + + + + + SV - Select your answer - + + + + + + + + + + LG + LG + LG + LG + + + sv - Select your answer - SV - Select your answer - SV - Select your answer - SV - Select your answer - sv - Select your answer - + + + + + + + + + + + + SG + + R, - Select your answer - R (R, - R - Select your answer - FS, IB, LG, LV, SG, SV - Select your answer - (b) Solve the model developed in part (a). If required, round your answers to two decimal places. If your answer is zero, enter "o". Portfolio Expected Return = % Mutual Fund Foreign Stock Intermediate-Term Bond Large-Cap Growth Large-Cap Value Small-Cap Growth Small-Cap Value Year 1 10.060 17.640 32.410 32.360 33.440 24.560 Year 2 13.120 3.250 18.710 20.610 19.400 25.320 Year 3 Year 4 13.470 45.420 7.510 -1.330 33.280 41.460 12.930 7.060 3.850 58.680 -6.700 .430 Year 5 -21.930 7.360 -23.260 -5.370 -9.020 17.310 Max R s.t + + + + + SV - Select your answer - + + + + + + + + + + LG + LG + LG + LG + + + sv - Select your answer - SV - Select your answer - SV - Select your answer - SV - Select your answer - sv - Select your answer - + + + + + + + + + + + + SG + + R, - Select your answer - R (R, - R - Select your answer - FS, IB, LG, LV, SG, SV - Select your answer - (b) Solve the model developed in part (a). If required, round your answers to two decimal places. If your answer is zero, enter "o". Portfolio Expected Return = %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts

= the expected return of the portfolio

= the expected return of the portfolio