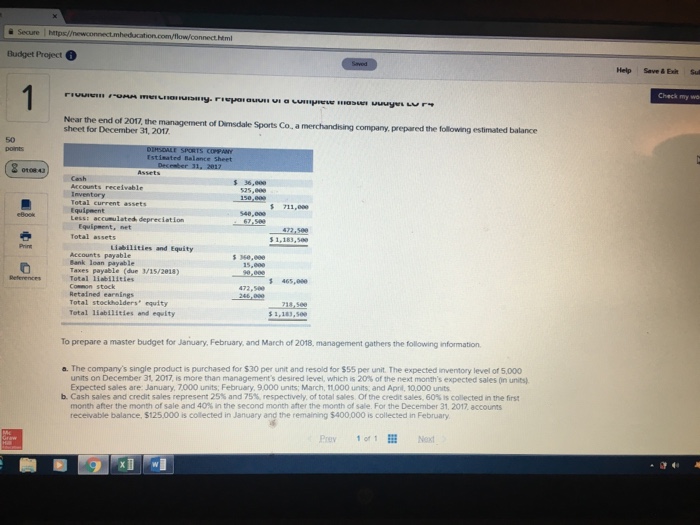

Question: a Secure https/ ucation.com/flow/connect.html Budget Project Help Save &ExitSu Near the end of 2017, the management of Dimsdale Sports Co, a merchandlsing company, prepared the

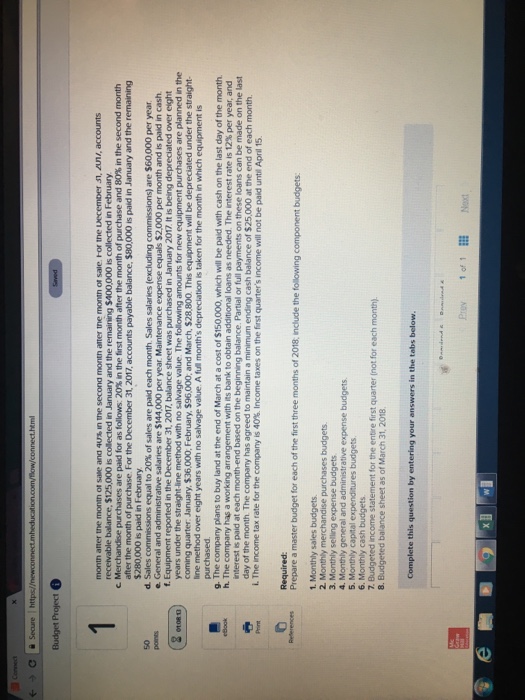

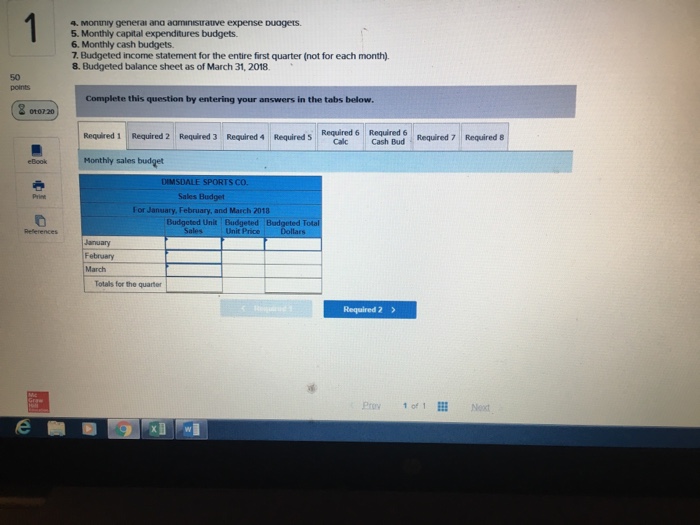

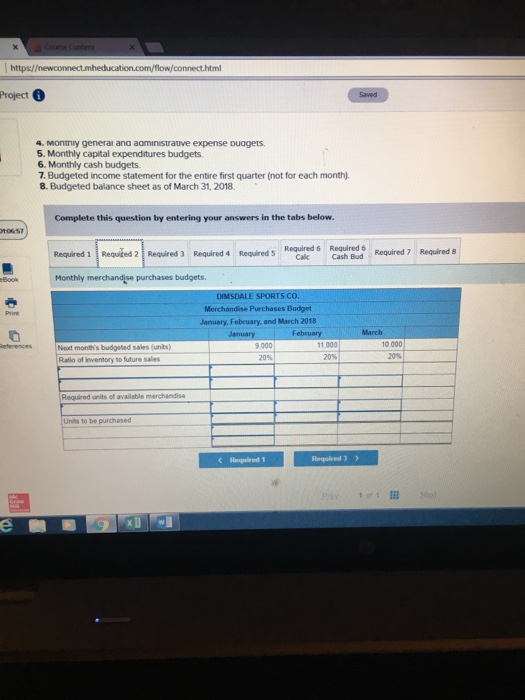

a Secure https/ ucation.com/flow/connect.html Budget Project Help Save &ExitSu Near the end of 2017, the management of Dimsdale Sports Co, a merchandlsing company, prepared the following estimated sheet for December 31, 2017 50 ance Sheet Cash al current assets s 711, 540,000 Less: accumulated depreciatIon Equipment, net Total assets Liabilities and Equity Accounts payable Bank loan payable Taxes paable (due 3/15/2018) Total liabilieles 5 360,990 15,800 5 465,000 472,5e Retained earnings Total stockholders equity Total liab1lities and equity 3,183,5ee To prepare a master budget for January, February, and March of 2018, management gathers the following information. a. The company's single product is purchased for $30 per unit and resold for $55 per unit. The expected inventory level of 5,000 b. Cash sales and credit sales represent 25% and 75% respectively of total sales of the credit sales, 60% s collected n ne frst units on December 31, 2017 is more than management's desired leve, which is 20% of the next month's expected sales on unit Expected sales are: January, 7000 units; February, 9.000 units; March, 11000 units and April, 10.000 units month after the month of sale and 40% in the second month after the month of sale. For the December 31, 2017, accounts receivable balance, $125.000 is collected in January and the remaining $400,000 is collected in February n January ang the remaining 40000s Prev 1 of 1

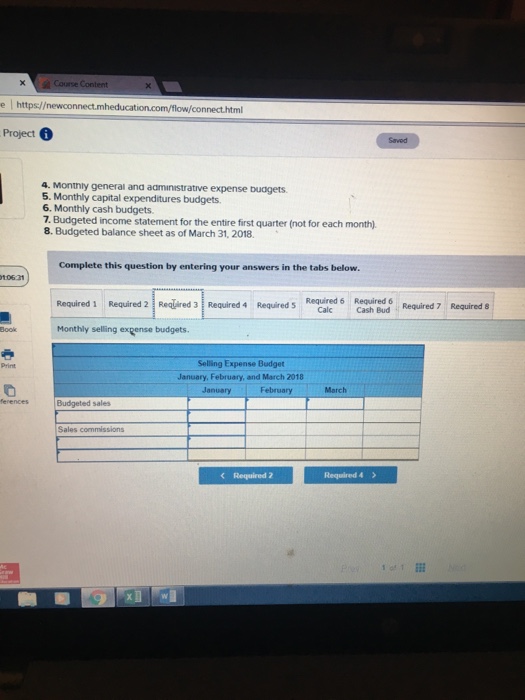

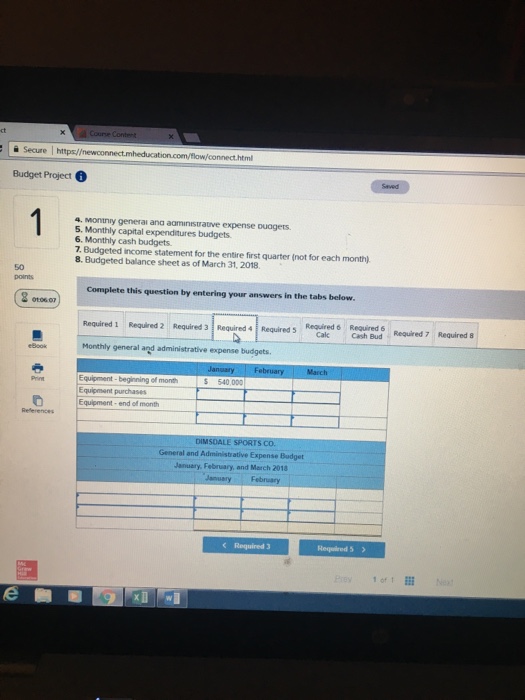

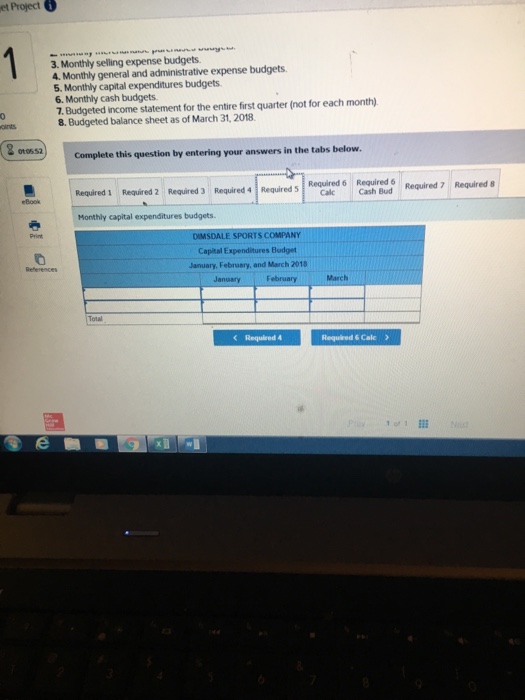

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts