Question: a. Security C has the same payoffs as what portfolio of the securities A and B? b. Security D has the same payoffs as what

a. Security C has the same payoffs as what portfolio of the securities A and B?

b. Security D has the same payoffs as what portfolio of the securities A and B?

c. What is the no-arbitrage price of security C?

d. What is the no-arbitrage price of security D?

e. What is the expected return of security C if both states are equally likely? What is its risk premium?

f. What is the expected return of security D if both states are equally likely? What is its risk premium?

g. What is the difference between the return of security C when the economy is strong and when it is weak?

h. If security C had a risk premium of

9.6%,

what arbitrage opportunity would be available?

i. What is the difference between the return of security D when the economy is strong and when it is weak?

j. If security D had a risk premium of

9.6%,

what arbitrage opportunity would be available?

Hello, Could you show your work regarding from a to j (question)?

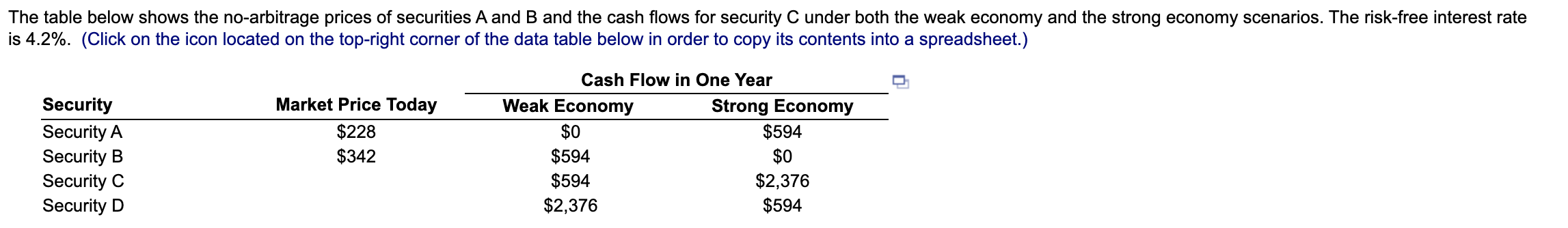

The table below shows the no-arbitrage prices of securities A and B and the cash flows for security C under both the weak economy and the strong economy scenarios. The risk-free interest rate is 4.2%. (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) Security Security A Security B Security C Security D Market Price Today $228 $342 Cash Flow in One Year Weak Economy Strong Economy $0 $594 $594 $0 $594 $2,376 $2,376 $594 The table below shows the no-arbitrage prices of securities A and B and the cash flows for security C under both the weak economy and the strong economy scenarios. The risk-free interest rate is 4.2%. (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) Security Security A Security B Security C Security D Market Price Today $228 $342 Cash Flow in One Year Weak Economy Strong Economy $0 $594 $594 $0 $594 $2,376 $2,376 $594

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts