Question: A security has an expected return of 3.2%, a volatility of 24.4%, and a beta of -0.89. Assuming the risk free rate is 0.9%, then

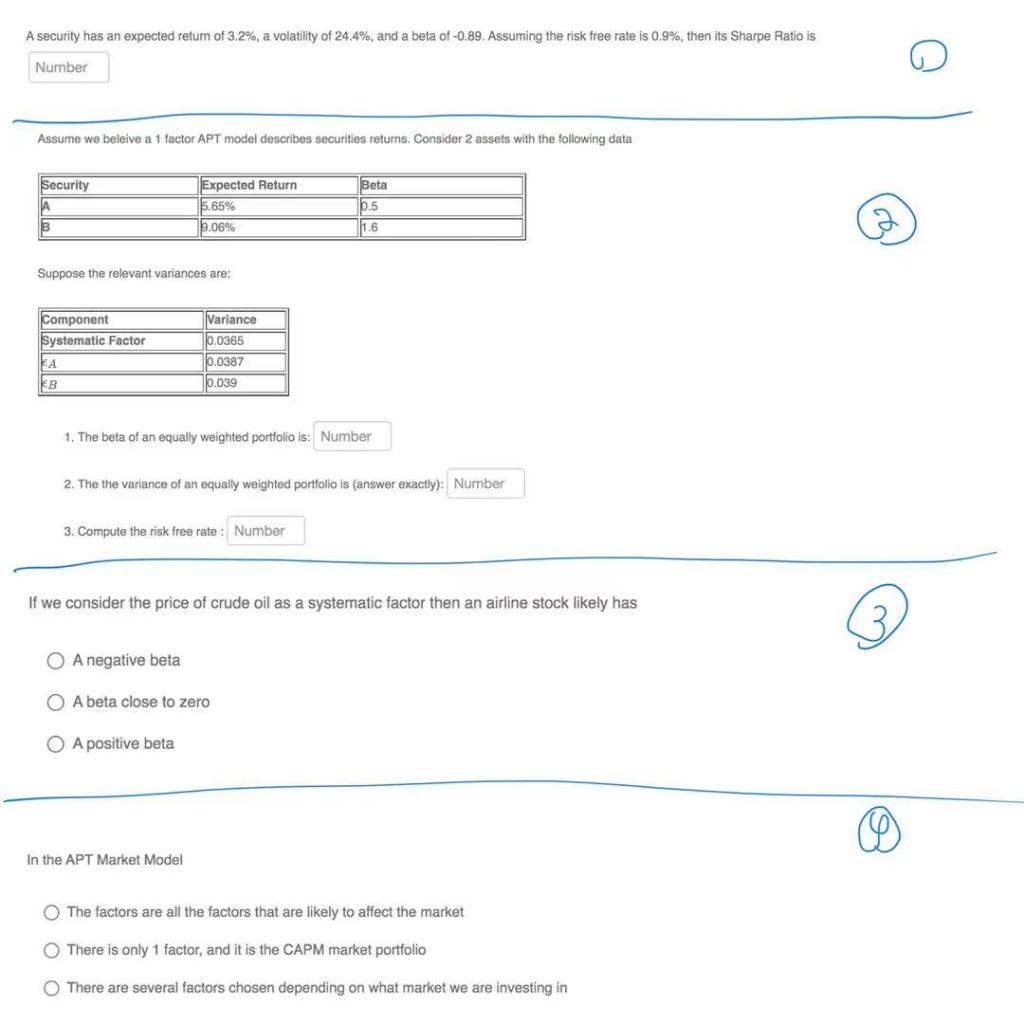

A security has an expected return of 3.2%, a volatility of 24.4%, and a beta of -0.89. Assuming the risk free rate is 0.9%, then its Sharpe Ratio is Number Assume we beleive a 1 factor APT model describes securities returns. Consider assets with the following data Security Beta Expected Return 5.65% 9.06% 0.5 111.6 Suppose the relevant variances are: Variance 10.0365 Component Systematic Factor KA 10.0387 0.039 1. The beta of an equally weighted portfolio is: Number 2. The the variance of an equally weighted portfolio is (answer exactly): Number 3. Compute the risk free rate : Number If we consider the price of crude oil as a systematic factor then an airline stock likely has O A negative beta A beta close to zero O A positive beta In the APT Market Model The factors are all the factors that are likely to affect the market There is only 1 factor, and it is the CAPM market portfolio There are several factors chosen depending on what market we are investing in

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts