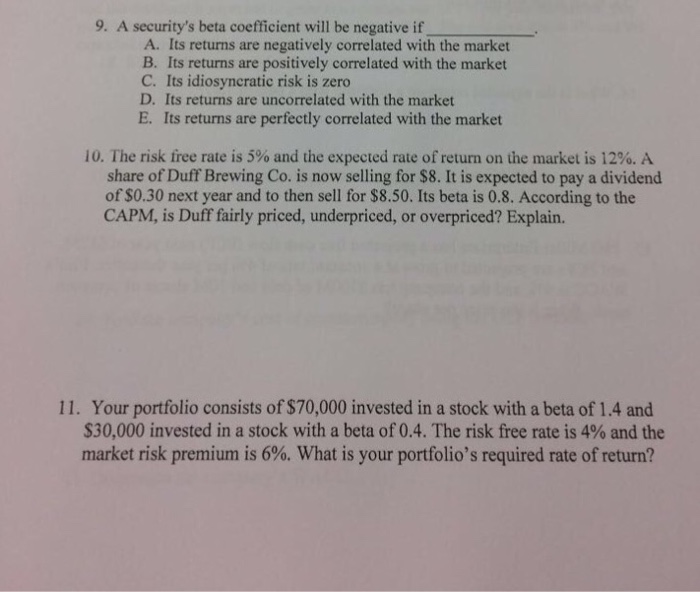

Question: A security's beta coefficient will be negative if____. A. Its returns are negatively correlated with the market B. Its returns are positively correlated with the

A security's beta coefficient will be negative if____. A. Its returns are negatively correlated with the market B. Its returns are positively correlated with the market C. Its idiosyncratic risk is zero D. Its returns are uncorrected with the market E. Its returns are perfectly correlated with the market The risk free rate is 5% and the expected rate of return on the market is 12%. A share of Duff Brewing Co. is now selling for exist8. It is expected to pay a dividend of exist0.30 next year and to then sell for exist8.50. Its beta is 0.8. According to the CAPM, is Duff fairly priced, underpriced, or overpriced? Explain. Your portfolio consists of exist70,000 invested in a stock with a beta of 1.4 and exist30,000 invested in a stock with a beta of 0.4. The risk free rate is 4% and the market risk premium is 6%. What is your portfolio's required rate of return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts