Question: A self-employed worker earns $40,000, how much will they pay in CPP contributions if the rate is 9.9 percent and the yearly maximum pensionable earnings

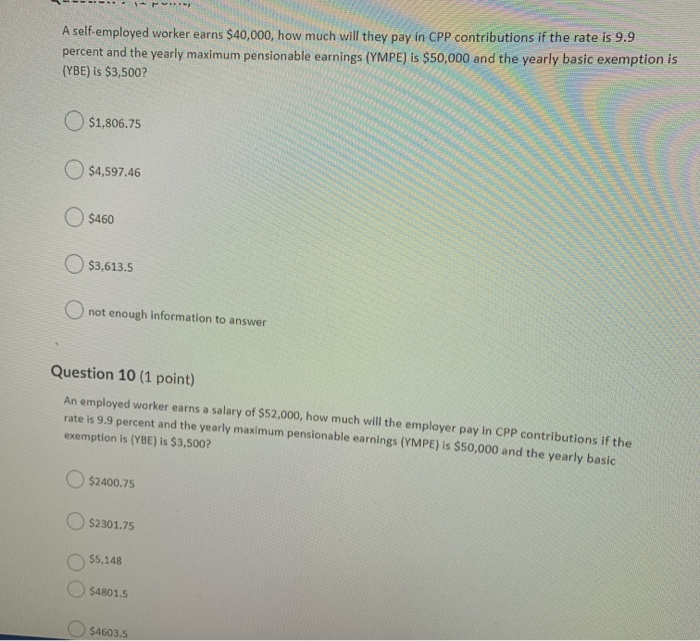

A self-employed worker earns $40,000, how much will they pay in CPP contributions if the rate is 9.9 percent and the yearly maximum pensionable earnings (YMPE) is $50,000 and the yearly basic exemption is (YBE) is $3,500? $1,806.75 $4,597.46 $460 $3,613.5 o not enough information to answer Question 10 (1 point) An employed worker earns a salary of $52,000, how much will the employer pay in CPP contributions if the rate is 9.9 percent and the yearly maximum pensionable earnings (YMPE) is $50,000 and the yearly basic exemption is (YBE) is $3,500? $2400.75 $2301.75 $5,148 $4801.5 $4603.5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts