Question: A share currently trades at $10 and will pay a dividend of 50 cents in one month's time. An investor can enter into a

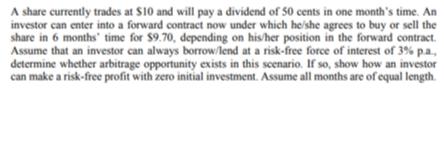

A share currently trades at $10 and will pay a dividend of 50 cents in one month's time. An investor can enter into a forward contract now under which he'she agrees to buy or sell the share in 6 months' time for $9.70, depending on his/her position in the forward contract. Assume that an investor can always borrow/lend at a risk-free force of interest of 3% pa, determine whether arbitrage opportunity exists in this scenario. If so, show how an investor can make a risk-free profit with zero initial investment. Assume all months are of equal length.

Step by Step Solution

3.41 Rating (160 Votes )

There are 3 Steps involved in it

STEP 1 A An arbitrage opportunity is like a technique wherein a pers... View full answer

Get step-by-step solutions from verified subject matter experts