Question: a) Share repurchases (4 points) TJ's has a market value equal to its book value. Currently, the firm has excess cash of $218,500, other assets

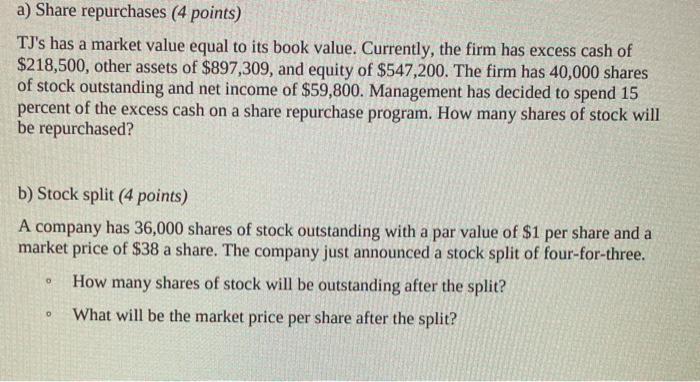

a) Share repurchases (4 points) TJ's has a market value equal to its book value. Currently, the firm has excess cash of $218,500, other assets of $897,309, and equity of $547,200. The firm has 40,000 shares of stock outstanding and net income of $59,800. Management has decided to spend 15 percent of the excess cash on a share repurchase program. How many shares of stock will be repurchased? b) Stock split (4 points) A company has 36,000 shares of stock outstanding with a par value of $1 per share and a market price of $38 a share. The company just announced a stock split of four-for-three. How many shares of stock will be outstanding after the split? What will be the market price per share after the split? 0 o

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts