Question: a) Show your calculation to determine whether the interest rate parity (IRP) holds. Spot rate: $0.055/ZAR 3-month forward rate: $0.058/ZAR. 3-month U.S interest rate:

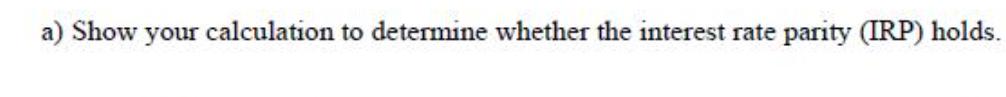

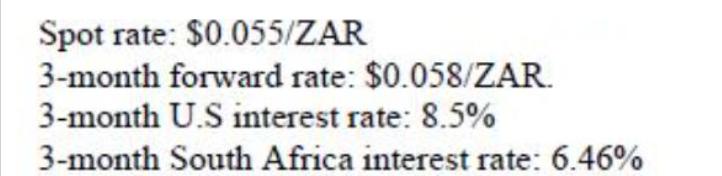

a) Show your calculation to determine whether the interest rate parity (IRP) holds. Spot rate: $0.055/ZAR 3-month forward rate: $0.058/ZAR. 3-month U.S interest rate: 8.5% 3-month South Africa interest rate: 6.46% b) If the IRP does not hold, how would you carry out covered interest arbitrage? Show all the steps and then determine the arbitrage profit. Assume that you can borrow as much as $1,500,000 or ZAR 27,272,727 to perform the covered interest arbitrate.

Step by Step Solution

There are 3 Steps involved in it

Carrying out Covered Interest Arbitrage Since the forward premium 364 is less than the interest rate ... View full answer

Get step-by-step solutions from verified subject matter experts