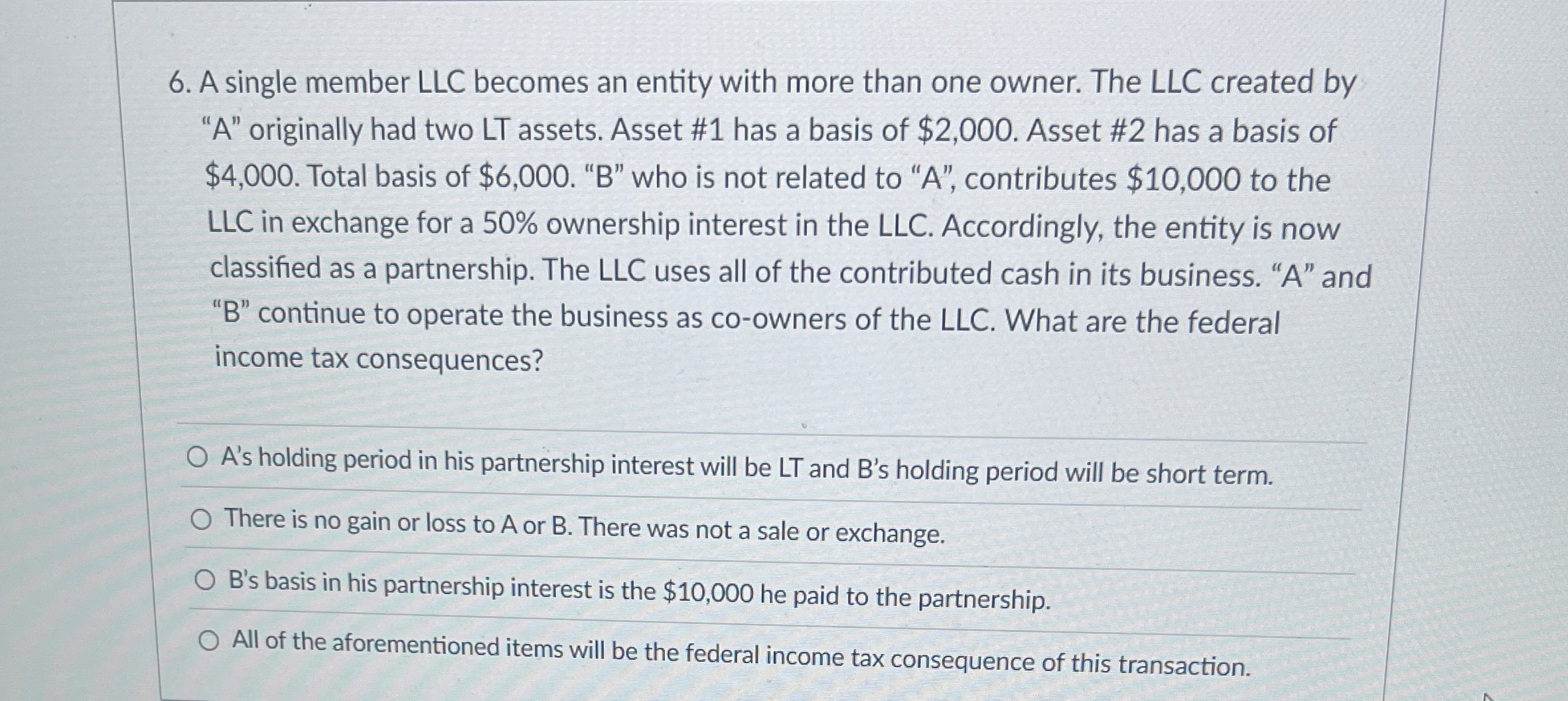

Question: A single member LLC becomes an entity with more than one owner. The LLC created by A originally had two LT assets. Asset

A single member LLC becomes an entity with more than one owner. The LLC created by

A originally had two LT assets. Asset # has a basis of $ Asset # has a basis of

$ Total basis of $ who is not related to contributes $ to the

LLC in exchange for a ownership interest in the LLC Accordingly, the entity is now

classified as a partnership. The LLC uses all of the contributed cash in its business. and

B continue to operate the business as coowners of the LLC What are the federal

income tax consequences?

As holding period in his partnership interest will be LT and Bs holding period will be short term.

There is no gain or loss to A or B There was not a sale or exchange.

Bs basis in his partnership interest is the $ he paid to the partnership.

All of the aforementioned items will be the federal income tax consequence of this transaction.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock