Question: A small renovation project is to be completed by a general contractor in 6 months for a total cost of $250,000. The projected monthly total

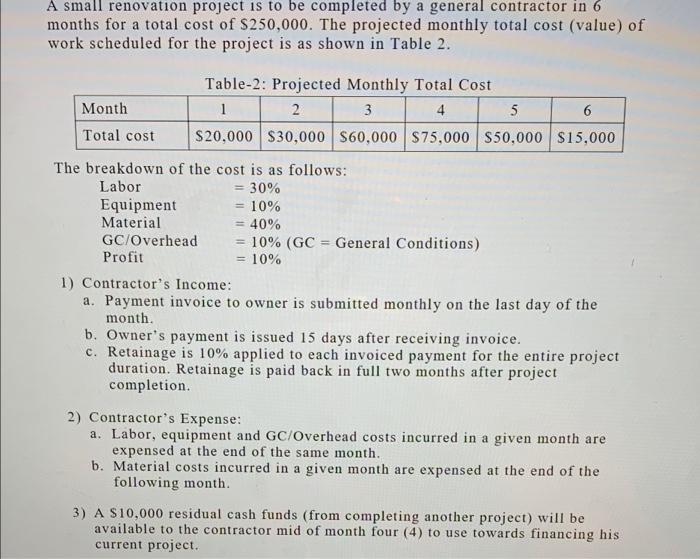

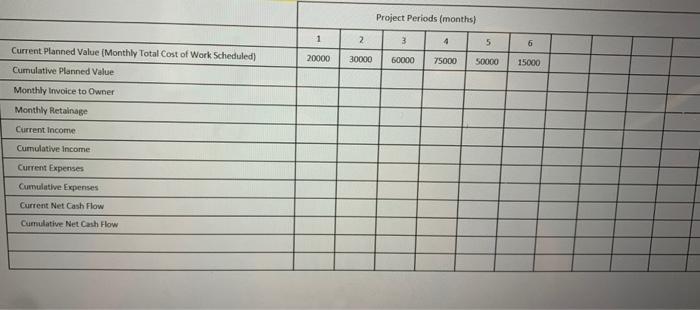

A small renovation project is to be completed by a general contractor in 6 months for a total cost of $250,000. The projected monthly total cost (value) of work scheduled for the project is as shown in Table 2. Table-2: Projected Monthly Total Cost Month 1 2 3 4 5 6 Total cost $20,000 $30,000 $60,000 $75,000 $50,000 $15,000 The breakdown of the cost is as follows: Labor = 30% Equipment -10% Material = 40% GC/Overhead - 10% (GC = General Conditions) Profit - 10% 1) Contractor's Income: a. Payment invoice to owner is submitted monthly on the last day of the month b. Owner's payment is issued 15 days after receiving invoice. c. Retainage is 10% applied to each invoiced payment for the entire project duration. Retainage is paid back in full two months after project completion. 2) Contractor's Expense: a. Labor, equipment and GC/Overhead costs incurred in a given month are expensed at the end of the same month. b. Material costs incurred in a given month are expensed at the end of the following month. 3) A $10,000 residual cash funds (from completing another project will be available to the contractor mid of month four (4) to use towards financing his current project. Project Periods (months) 1 2 3 4 5 6 Current Planned Value (Monthly Total Cost of Work Scheduled) Cumulative Planned Value 20000 30000 60000 75000 50000 15000 Monthly Invoice to Owner Monthly Retainage Current Income Cumulative Income Current Expenses Cumulative Expenses Current Net Cash Flow Cumulative Net Cash Flow A small renovation project is to be completed by a general contractor in 6 months for a total cost of $250,000. The projected monthly total cost (value) of work scheduled for the project is as shown in Table 2. Table-2: Projected Monthly Total Cost Month 1 2 3 4 5 6 Total cost $20,000 $30,000 $60,000 $75,000 $50,000 $15,000 The breakdown of the cost is as follows: Labor = 30% Equipment -10% Material = 40% GC/Overhead - 10% (GC = General Conditions) Profit - 10% 1) Contractor's Income: a. Payment invoice to owner is submitted monthly on the last day of the month b. Owner's payment is issued 15 days after receiving invoice. c. Retainage is 10% applied to each invoiced payment for the entire project duration. Retainage is paid back in full two months after project completion. 2) Contractor's Expense: a. Labor, equipment and GC/Overhead costs incurred in a given month are expensed at the end of the same month. b. Material costs incurred in a given month are expensed at the end of the following month. 3) A $10,000 residual cash funds (from completing another project will be available to the contractor mid of month four (4) to use towards financing his current project. Project Periods (months) 1 2 3 4 5 6 Current Planned Value (Monthly Total Cost of Work Scheduled) Cumulative Planned Value 20000 30000 60000 75000 50000 15000 Monthly Invoice to Owner Monthly Retainage Current Income Cumulative Income Current Expenses Cumulative Expenses Current Net Cash Flow Cumulative Net Cash Flow

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts