Question: A small strip-mining coal company is trying to decide whether it should purchase or lease a new clamshell. If purchased, the shell will cost $130,000

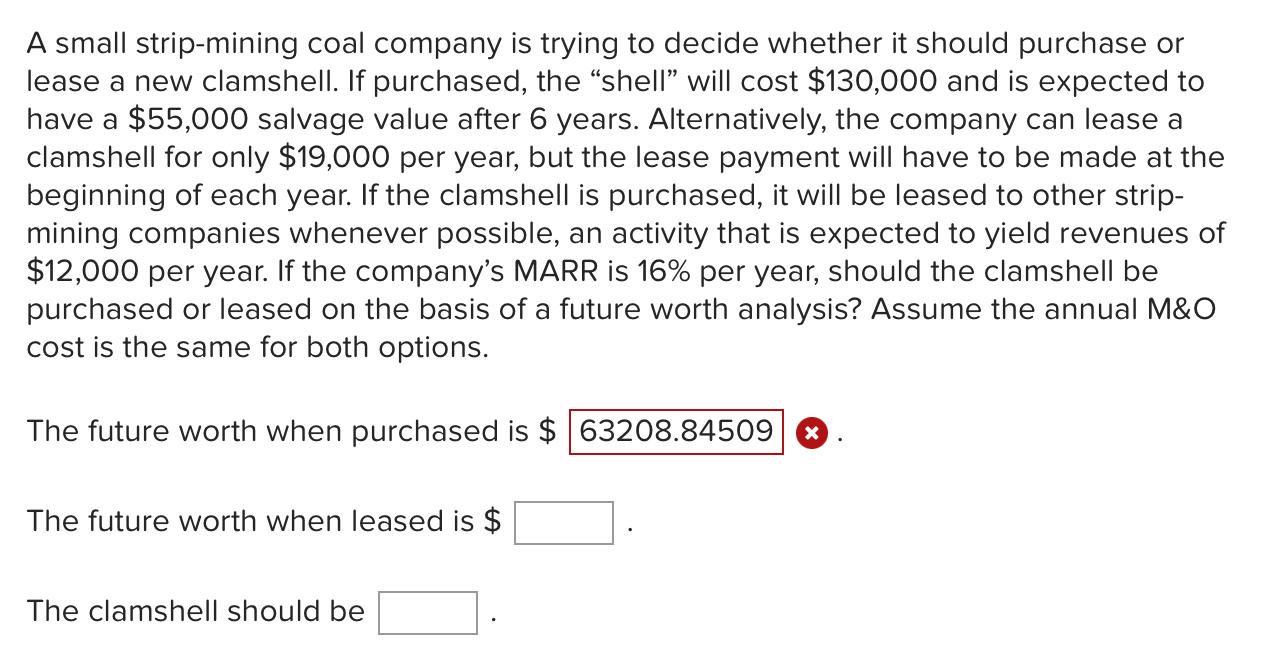

A small strip-mining coal company is trying to decide whether it should purchase or lease a new clamshell. If purchased, the "shell" will cost $130,000 and is expected to have a $55,000 salvage value after 6 years. Alternatively, the company can lease a clamshell for only $19,000 per year, but the lease payment will have to be made at the beginning of each year. If the clamshell is purchased, it will be leased to other stripmining companies whenever possible, an activity that is expected to yield revenues of $12,000 per year. If the company's MARR is 16% per year, should the clamshell be purchased or leased on the basis of a future worth analysis? Assume the annual M&O cost is the same for both options. The future worth when purchased is $ The future worth when leased is $ The clamshell should be A small strip-mining coal company is trying to decide whether it should purchase or lease a new clamshell. If purchased, the "shell" will cost $130,000 and is expected to have a $55,000 salvage value after 6 years. Alternatively, the company can lease a clamshell for only $19,000 per year, but the lease payment will have to be made at the beginning of each year. If the clamshell is purchased, it will be leased to other stripmining companies whenever possible, an activity that is expected to yield revenues of $12,000 per year. If the company's MARR is 16% per year, should the clamshell be purchased or leased on the basis of a future worth analysis? Assume the annual M&O cost is the same for both options. The future worth when purchased is $ The future worth when leased is $ The clamshell should be

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts