Question: Check my work 6 Problem 05.031 Future Worth Analysis A small strip-mining coal company is trying to decide whether it should purchase or lease a

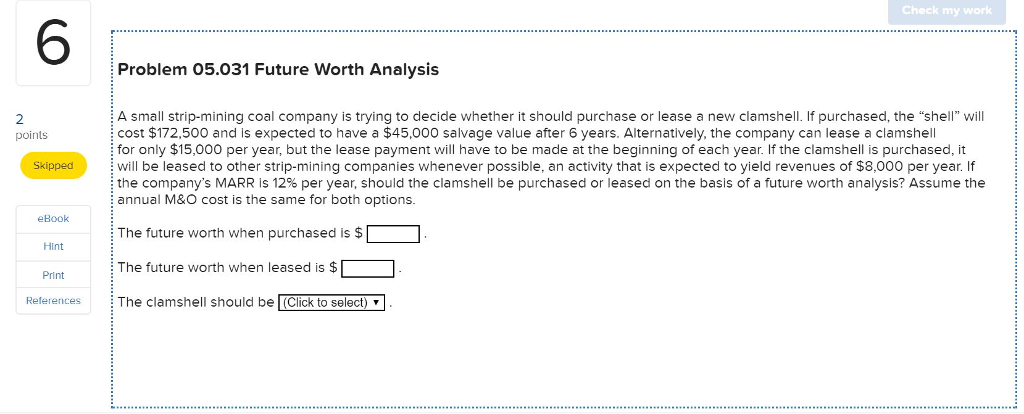

Check my work 6 Problem 05.031 Future Worth Analysis A small strip-mining coal company is trying to decide whether it should purchase or lease a new clamshell. If purchased, the "shell" will cost $172,500 and is expected to have a $45,000 salvage value after 6 years. Alternatively, the company can lease a clamshell for only $15,000 per year, but the lease payment will have to be made at the beginning of each year. If the clamshell is purchased, it will be leased to other strip-mining companies whenever possible, an activity that is expected to yield revenues of $8,000 per year. If . the company's MARR is 12% per year, should the clamshell be purchased or leased on the basis of a future worth analysis? Assume the annual M&O cost is the same for both options. points Skipped eBook The future worth when purchased is $ Hint Prnt The future worth when leased is $ References The clamshell should be (Click to select)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts