Question: a) Stan Berhad expects to earn RM150,000.00 next year after taxes on sales of RM2,200,000.00. Stan Berhad manufactures only one size of garbage can. Stan

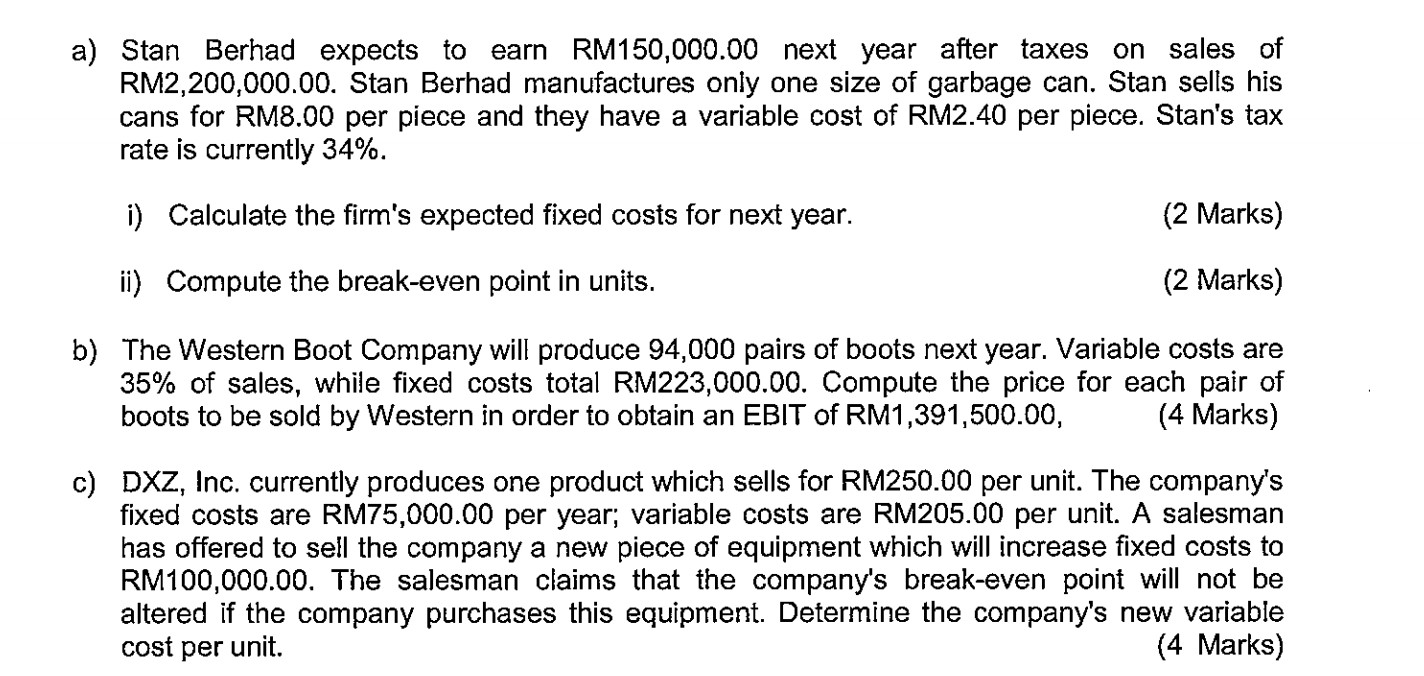

a) Stan Berhad expects to earn RM150,000.00 next year after taxes on sales of RM2,200,000.00. Stan Berhad manufactures only one size of garbage can. Stan sells his cans for RM8.00 per piece and they have a variable cost of RM2.40 per piece. Stan's tax rate is currently 34%. i) Calculate the firm's expected fixed costs for next year. (2 Marks) ii) Compute the break-even point in units. (2 Marks) b) The Western Boot Company will produce 94,000 pairs of boots next year. Variable costs are 35% of sales, while fixed costs total RM223,000.00. Compute the price for each pair of boots to be sold by Western in order to obtain an EBIT of RM1,391,500.00, (4 Marks) C) DXZ, Inc. currently produces one product which sells for RM250.00 per unit. The company's fixed costs are RM75,000.00 per year; variable costs are RM205.00 per unit. A salesman has offered to sell the company a new piece of equipment which will increase fixed costs to RM100,000.00. The salesman claims that the company's break-even point will not be altered if the company purchases this equipment. Determine the company's new variable cost per unit. (4 Marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts