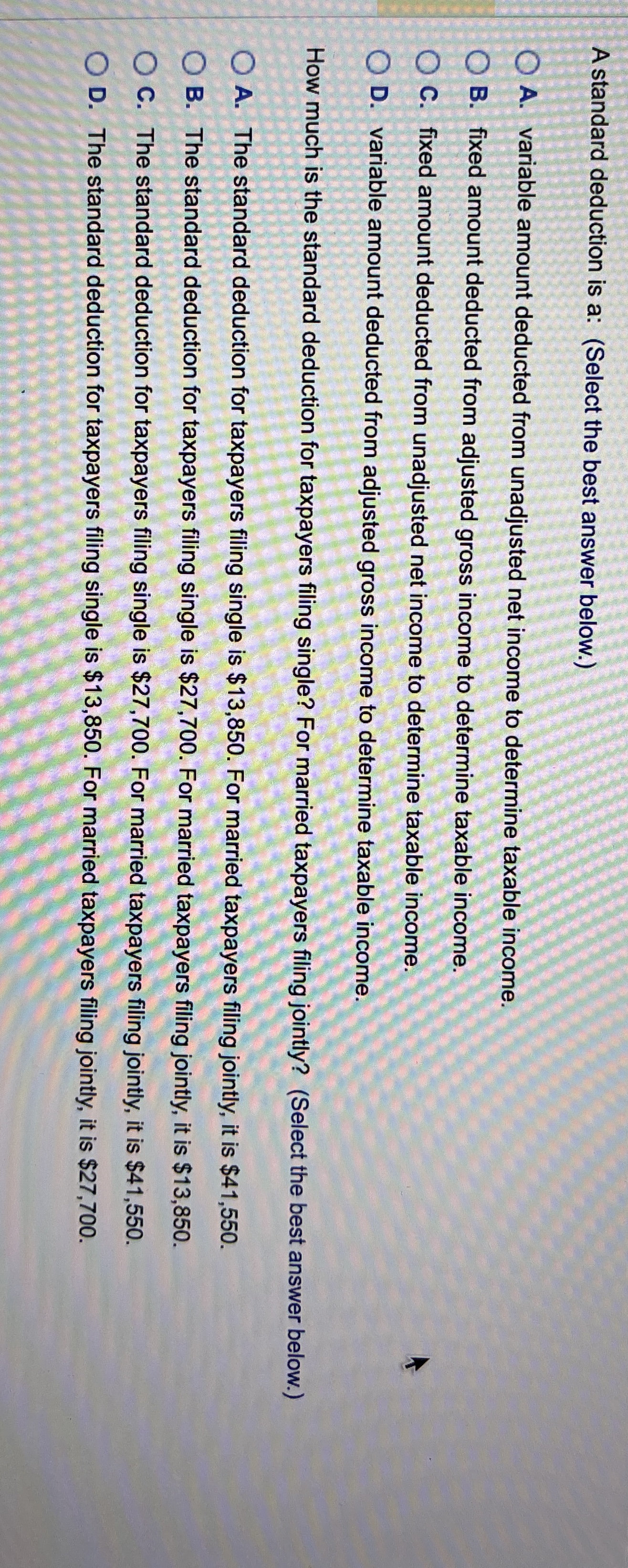

Question: A standard deduction is a: ( Select the best answer below. ) A . variable amount deducted from unadjusted net income to determine taxable income.

A standard deduction is a: Select the best answer below.

A variable amount deducted from unadjusted net income to determine taxable income.

B fixed amount deducted from adjusted gross income to determine taxable income.

C fixed amount deducted from unadjusted net income to determine taxable income.

D variable amount deducted from adjusted gross income to determine taxable income.

How much is the standard deduction for taxpayers filing single? For married taxpayers filing jointly? Select the best answer below.

A The standard deduction for taxpayers filing single is $ For married taxpayers filing jointly, it is $

B The standard deduction for taxpayers filing single is $ For married taxpayers filing jointly, it is $

C The standard deduction for taxpayers filing single is $ For married taxpayers filing jointly, it is $

D The standard deduction for taxpayers filing single is $ For married taxpayers filing jointly, it is $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock