Question: a. State why would an investor expect low correlation in the rates of return for domestic and foreign securities as a result of international diversification

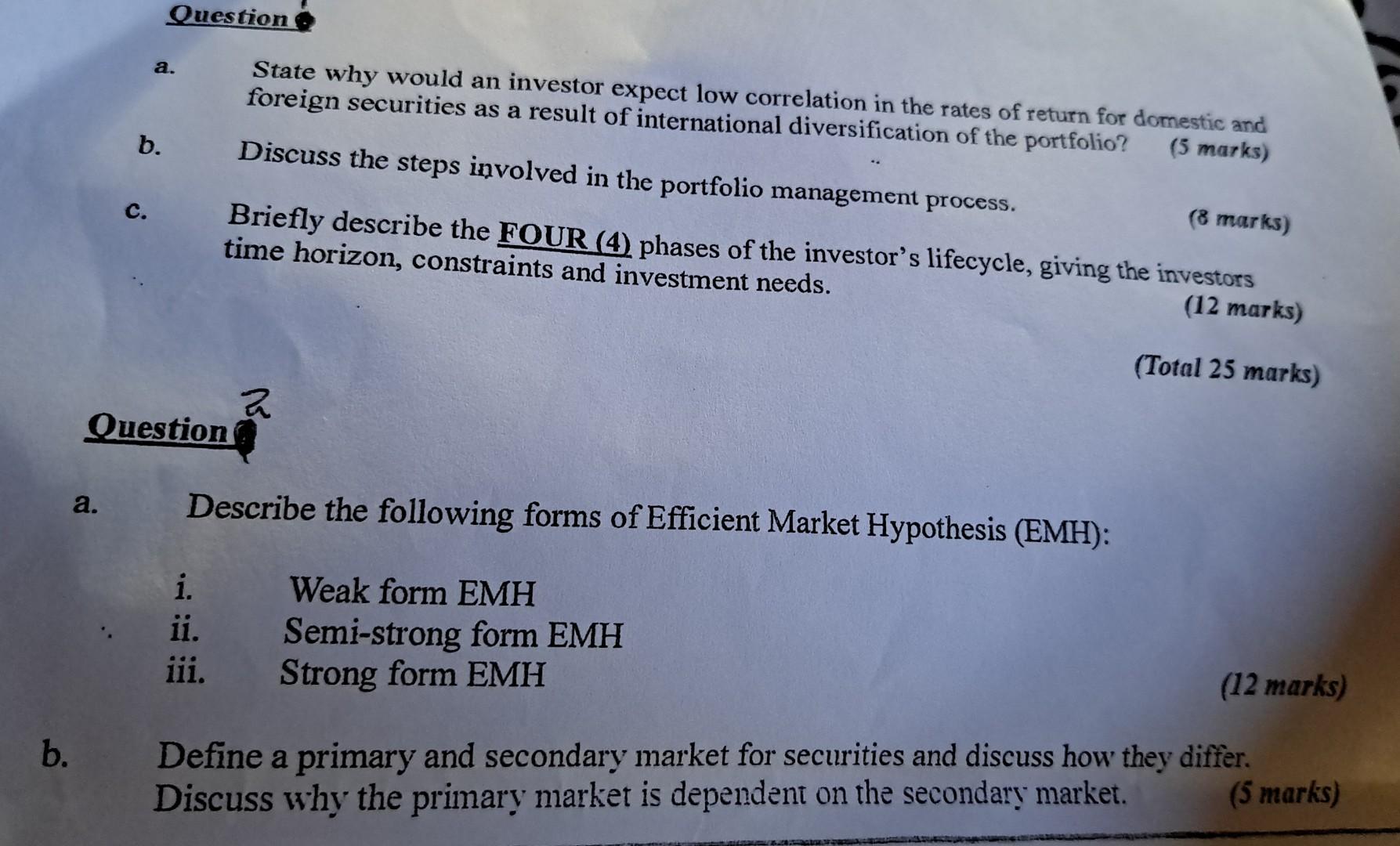

a. State why would an investor expect low correlation in the rates of return for domestic and foreign securities as a result of international diversification of the portfolio? (5 marks) b. Discuss the steps involved in the portfolio management process. c. Briefly describe the FOUR (4) phases of the investor's lifecycle, giving the investors time horizon, constraints and investment needs. (12 marks) (Total 25 marks) Question? a. Describe the following forms of Efficient Market Hypothesis (EMH): i. Weak form EMH ii. Semi-strong form EMH iii. Strong form EMH (12 marks) b. Define a primary and secondary market for securities and discuss how they differ. Discuss why the primary market is dependent on the secondary market

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts