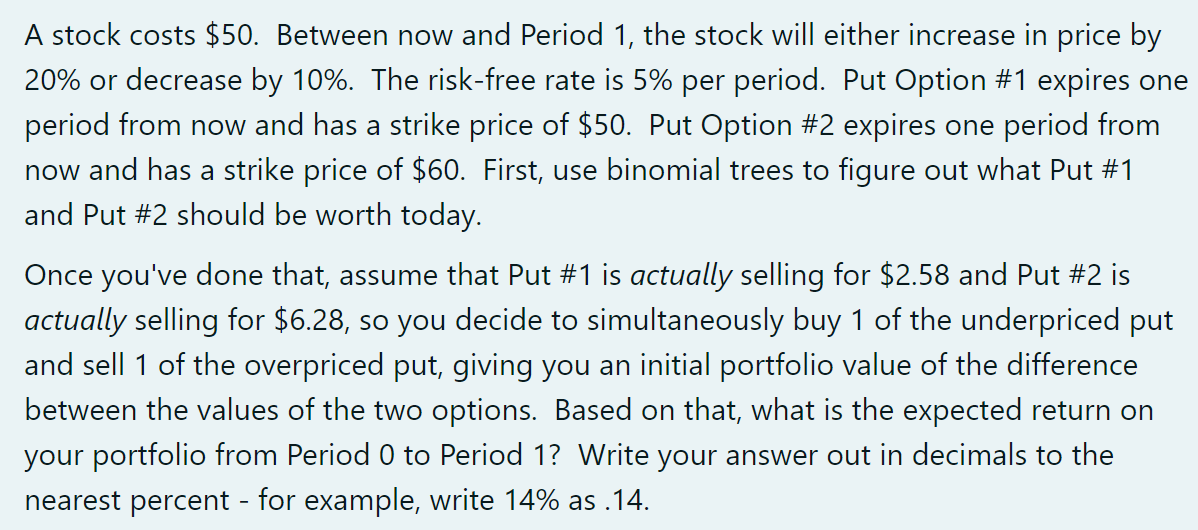

Question: A stock costs $ 5 0 . Between now and Period 1 , the stock will either increase in price by 2 0 % or

A stock costs $ Between now and Period the stock will either increase in price by

or decrease by The riskfree rate is per period. Put Option # expires one

period from now and has a strike price of $ Put Option # expires one period from

now and has a strike price of $ First, use binomial trees to figure out what Put #

and Put # should be worth today.

Once you've done that, assume that Put # is actually selling for $ and Put # is

actually selling for $ so you decide to simultaneously buy of the underpriced put

and sell of the overpriced put, giving you an initial portfolio value of the difference

between the values of the two options. Based on that, what is the expected return on

your portfolio from Period to Period Write your answer out in decimals to the

nearest percent for example, write as

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock