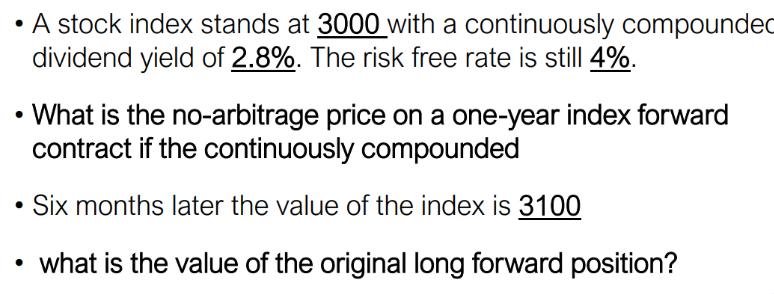

Question: A stock index stands at 3000 with a continuously compounded dividend yield of 2.8%. The risk free rate is still 4%. What is the

A stock index stands at 3000 with a continuously compounded dividend yield of 2.8%. The risk free rate is still 4%. What is the no-arbitrage price on a one-year index forward contract if the continuously compounded Six months later the value of the index is 3100 what is the value of the original long forward position?

Step by Step Solution

★★★★★

3.41 Rating (145 Votes )

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

To calculate the value of the original long forward position yo... View full answer

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock