Question: Answer all the Questions in the attachment Below.. a i. Distinguish between price limit and a position limit as applied in derivatives markets. ii. Explain

Answer all the Questions in the attachment Below..

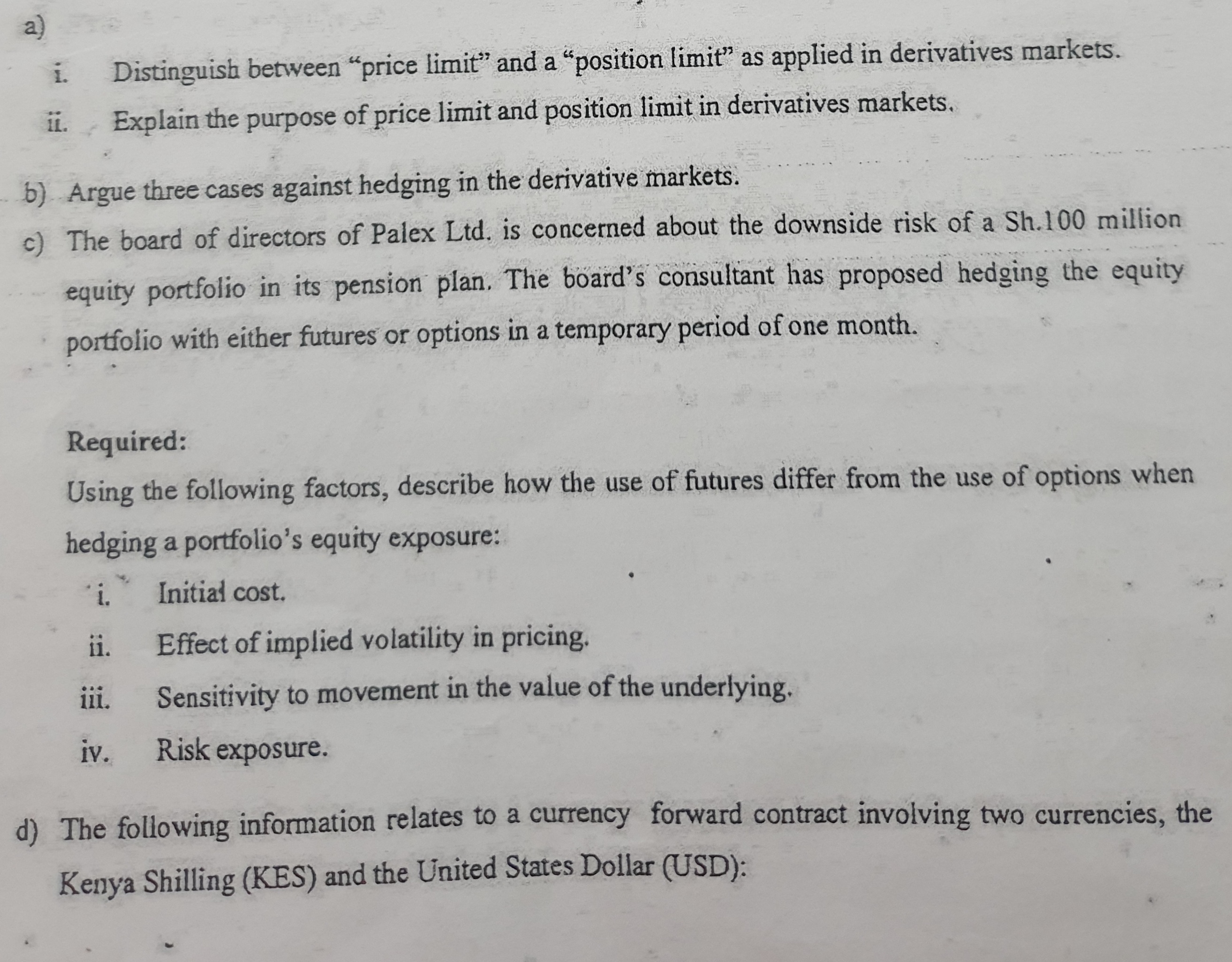

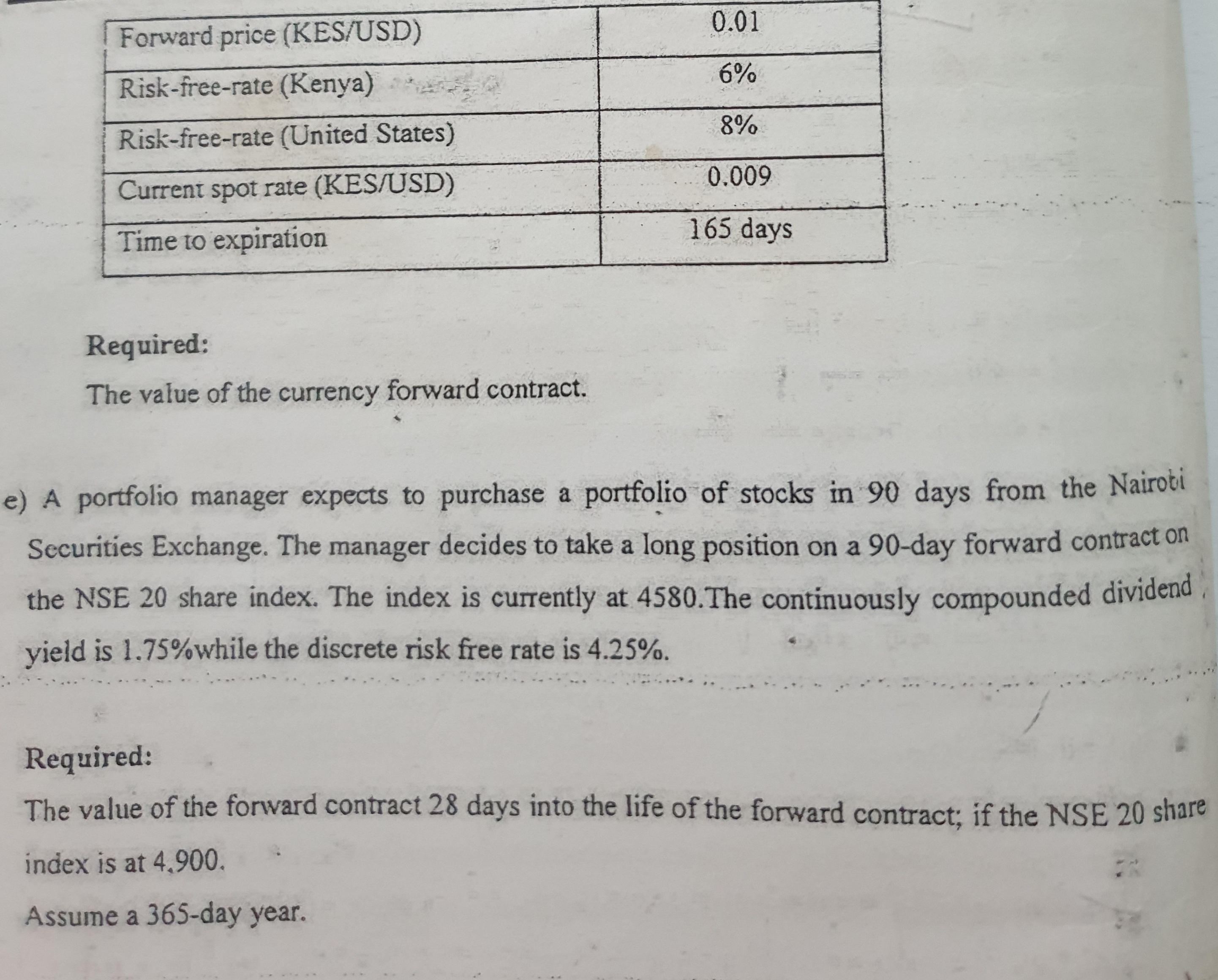

a i. Distinguish between "price limit" and a "position limit" as applied in derivatives markets. ii. Explain the purpose of price limit and position limit in derivatives markets. b) Argue three cases against hedging in the derivative markets. c) The board of directors of Palex Lid. is concerned about the downside risk of a Sh.100 million equity portfolio in its pension plan. The board's consultant has proposed hedging the equity portfolio with either futures or options in a temporary period of one month. Required: Using the following factors, describe how the use of futures differ from the use of options when hedging a portfolio's equity exposure: i. Initial cost. ii. Effect of implied volatility in pricing. iii. Sensitivity to movement in the value of the underlying. iv. Risk exposure. d) The following information relates to a currency forward contract involving two currencies, the Kenya Shilling (KES) and the United States Dollar (USD):Forward price (KES/USD) 0.01 Risk-free-rate (Kenya) 6% Risk-free-rate (United States) 8% Current spot rate (KES/USD) 0.009 Time to expiration 165 days Required: The value of the currency forward contract. e) A portfolio manager expects to purchase a portfolio of stocks in 90 days from the Nairobi Securities Exchange. The manager decides to take a long position on a 90-day forward contract on the NSE 20 share index. The index is currently at 4580. The continuously compounded dividend yield is 1.75%while the discrete risk free rate is 4.25%. .... ... .. .. ....". ... ............... . Required: The value of the forward contract 28 days into the life of the forward contract; if the NSE 20 share index is at 4,900. Assume a 365-day year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts