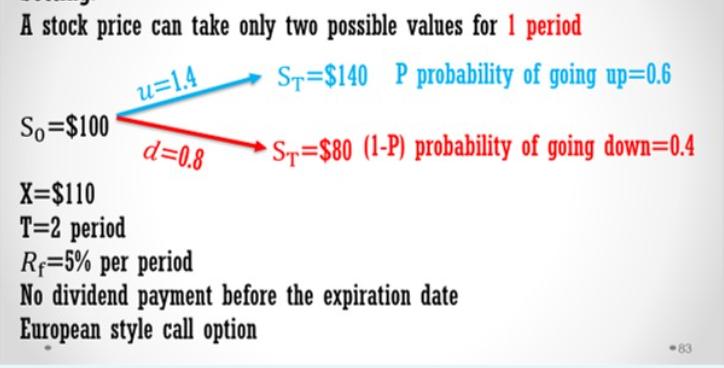

Question: A stock price can take only two possible values for 1 period u=1.4 So $100 d=0.8 ST-$140 P probability of going up=0.6 ST-$80 (1-P)

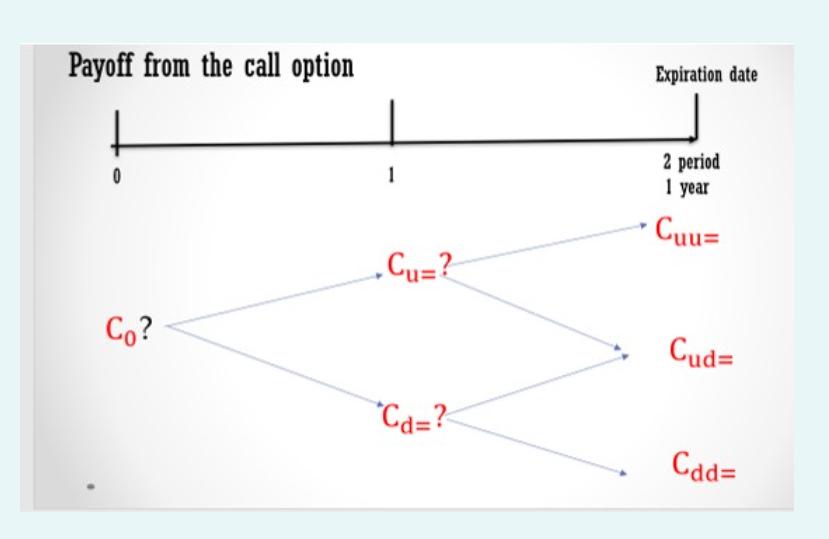

A stock price can take only two possible values for 1 period u=1.4 So $100 d=0.8 ST-$140 P probability of going up=0.6 ST-$80 (1-P) probability of going down=0.4 X=$110 T=2 period R 5% per period No dividend payment before the expiration date European style call option -83

Step by Step Solution

3.40 Rating (163 Votes )

There are 3 Steps involved in it

Binomial Option Pricing Model It provides investors with a tool to help evaluate stock options It as... View full answer

Get step-by-step solutions from verified subject matter experts