Question: A stock price evolves in a standard binomial tree. Each period it can either go up to u = 1.2 times its previous price or

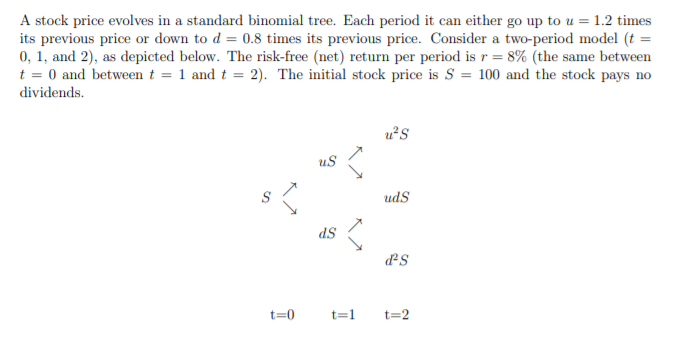

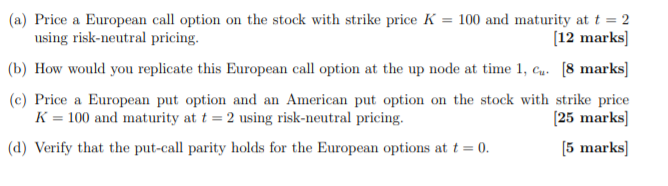

A stock price evolves in a standard binomial tree. Each period it can either go up to u = 1.2 times its previous price or down to d = 0.8 times its previous price. Consider a two-period model (t = 0, 1, and 2), as depicted below. The risk-free (net) return per period is r = 8% (the same between t = 0 and between t = 1 and t = 2). The initial stock price is S = 100 and the stock pays no dividends. u's US s uds ds -S t=0 t=1 t=2 (a) Price a European call option on the stock with strike price K = 100 and maturity at t = 2 (12 marks] using risk-neutral pricing. (b) How would you replicate this European call option at the up node at time 1, C. (8 marks] (e) Price a European put option and an American put option on the stock with strike price K = 100 and maturity at t = 2 using risk-neutral pricing. [25 marks) (d) Verify that the put-call parity holds for the European options at t = 0. [5 marks] A stock price evolves in a standard binomial tree. Each period it can either go up to u = 1.2 times its previous price or down to d = 0.8 times its previous price. Consider a two-period model (t = 0, 1, and 2), as depicted below. The risk-free (net) return per period is r = 8% (the same between t = 0 and between t = 1 and t = 2). The initial stock price is S = 100 and the stock pays no dividends. u's US s uds ds -S t=0 t=1 t=2 (a) Price a European call option on the stock with strike price K = 100 and maturity at t = 2 (12 marks] using risk-neutral pricing. (b) How would you replicate this European call option at the up node at time 1, C. (8 marks] (e) Price a European put option and an American put option on the stock with strike price K = 100 and maturity at t = 2 using risk-neutral pricing. [25 marks) (d) Verify that the put-call parity holds for the European options at t = 0. [5 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts