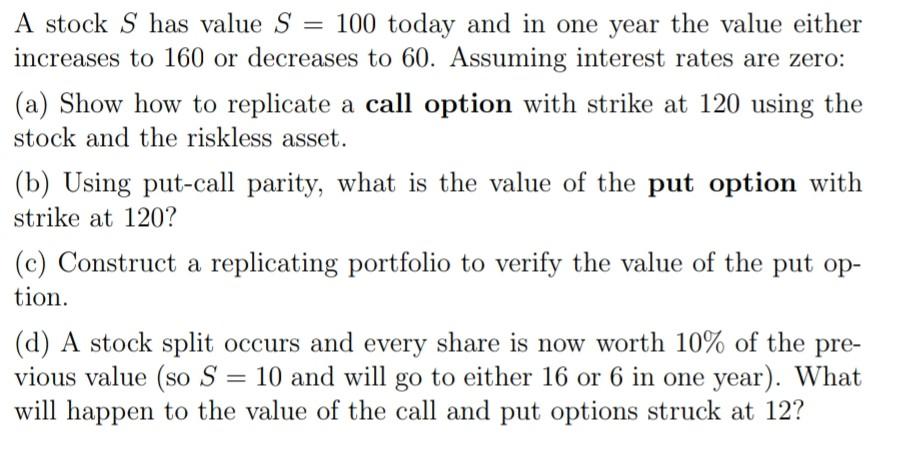

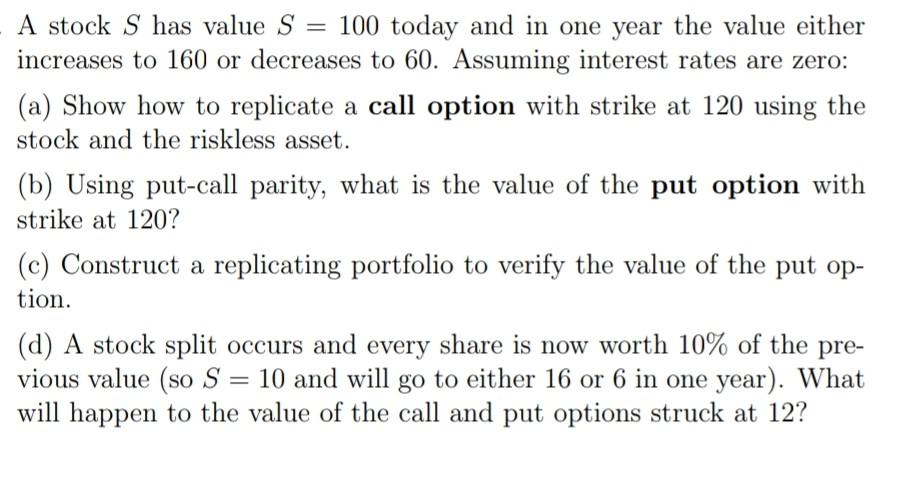

Question: = A stock S has value S = 100 today and in one year the value either increases to 160 or decreases to 60. Assuming

= A stock S has value S = 100 today and in one year the value either increases to 160 or decreases to 60. Assuming interest rates are zero: (a) Show how to replicate a call option with strike at 120 using the stock and the riskless asset. (b) Using put-call parity, what is the value of the put option with strike at 120? (c) Construct a replicating portfolio to verify the value of the put op- tion. (d) A stock split occurs and every share is now worth 10% of the pre- vious value (so S = 10 and will go to either 16 or 6 in one year). What will happen to the value of the call and put options struck at 12? A stock S has value S 100 today and in one year the value either increases to 160 or decreases to 60. Assuming interest rates are zero: (a) Show how to replicate a call option with strike at 120 using the stock and the riskless asset. (b) Using put-call parity, what is the value of the put option with strike at 120? (c) Construct a replicating portfolio to verify the value of the put op- tion. (d) A stock split occurs and every share is now worth 10% of the pre- vious value (so S = 10 and will go to either 16 or 6 in one year). What will happen to the value of the call and put options struck at 12

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts