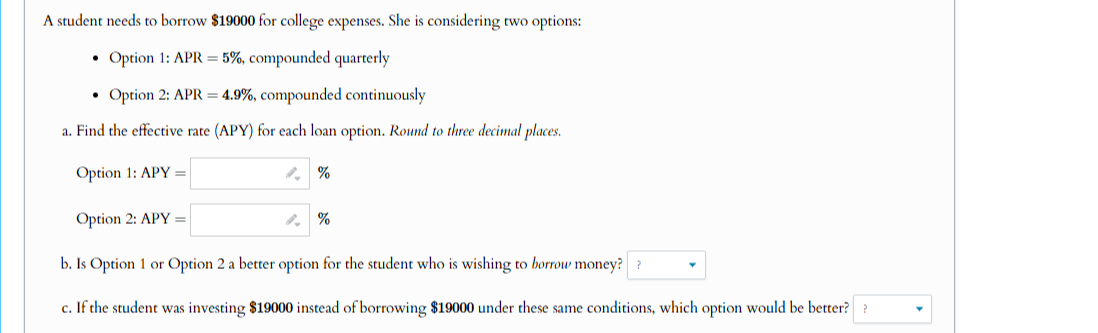

Question: A student needs to borrow ( $ 1 9 0 0 0 ) for college expenses. She is considering two options: -

A student needs to borrow $ for college expenses. She is considering two options:

Option : mathrmAPRmathbf compounded quarterly

Option : mathrmAPR compounded continuously

a Find the effective rate APY for each loan option. Round to three decimal places.

Option : APY

Option : APY

b Is Option or Option a better option for the student who is wishing to borrow money?

c If the student was investing $ instead of borrowing $ under these same conditions, which option would be better?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock