Question: Bonita Company has a factory machine with a book value of $152,000 and a remaining useful life of 4 years. A new machine is

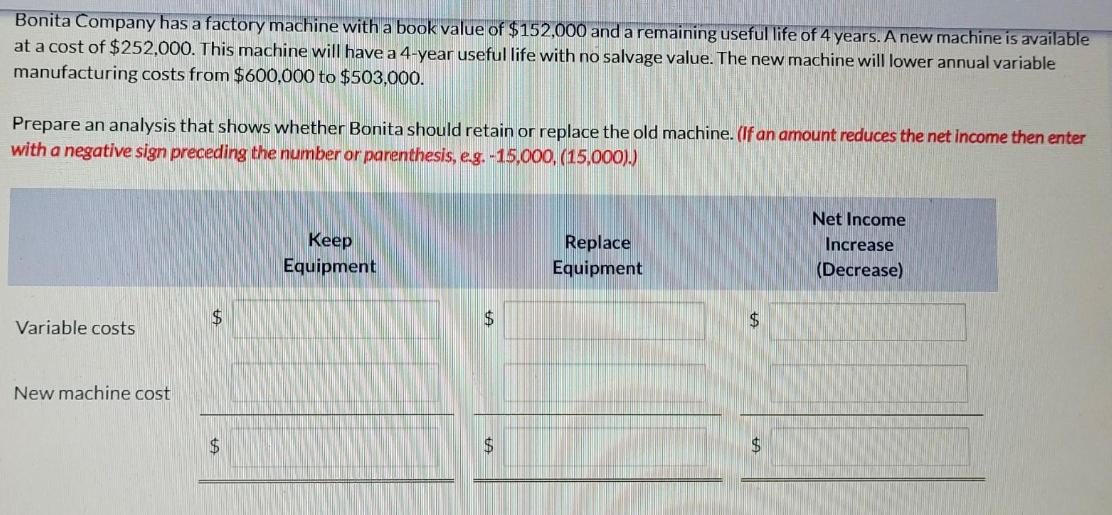

Bonita Company has a factory machine with a book value of $152,000 and a remaining useful life of 4 years. A new machine is available at a cost of $252,000. This machine will have a 4-year useful life with no salvage value. The new machine will lower annual variable manufacturing costs from $600,000 to $503,000. Prepare an analysis that shows whether Bonita should retain or replace the old machine. (If an amount reduces the net income then enter with a negative sign preceding the number or parenthesis, e.g. -15,000, (15,000).) Variable costs New machine cost $ $ Keep Equipment $ $ Replace Equipment $ $ Net Income Increase (Decrease)

Step by Step Solution

3.51 Rating (164 Votes )

There are 3 Steps involved in it

To determine whether Bonita Company should retain or replace the old machine we need to analyze the ... View full answer

Get step-by-step solutions from verified subject matter experts