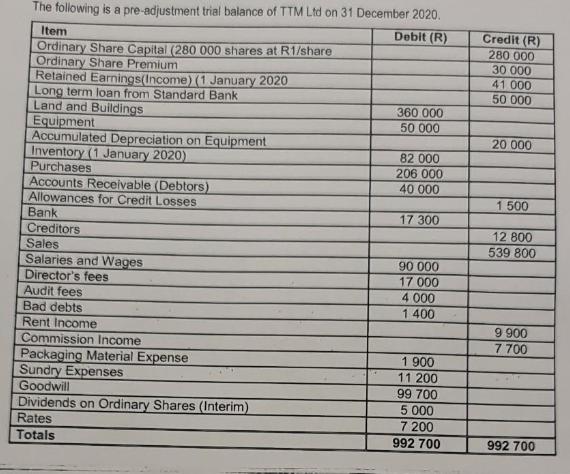

Question: The following is a pre-adjustment trial balance of TTM Ltd on 31 December 2020. Debit (R) Item Ordinary Share Capital (280 000 shares at

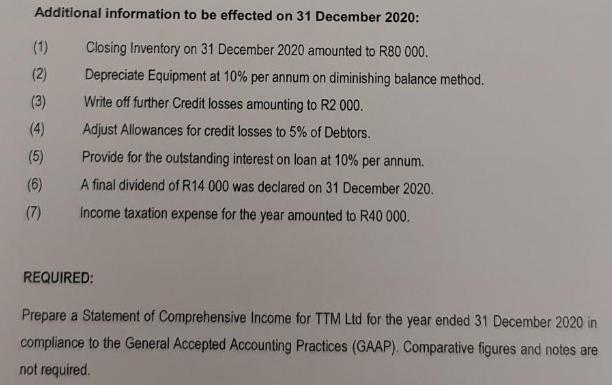

The following is a pre-adjustment trial balance of TTM Ltd on 31 December 2020. Debit (R) Item Ordinary Share Capital (280 000 shares at R1/share Ordinary Share Premium Retained Earnings (Income) (1 January 2020 Long term loan from Standard Bank Land and Buildings Equipment Accumulated Depreciation on Equipment Inventory (1 January 2020) Purchases Accounts Receivable (Debtors) Allowances for Credit Losses Bank Creditors Sales Salaries and Wages Director's fees Audit fees Bad debts Rent Income Commission Income Packaging Material Expense Sundry Expenses Goodwill Dividends on Ordinary Shares (Interim) Rates Totals MEM 360 000 50 000 82 000 206 000 40 000 17 300 90 000 17 000 4 000 1 400 1900 11 200 99 700 5 000 7 200 992 700 Credit (R) 280 000 30 000 41.000 50 000 20 000 1.500 12 800 539 800 9 900 7700 992 700 Additional information to be effected on 31 December 2020: Closing Inventory on 31 December 2020 amounted to R80 000. Depreciate Equipment at 10% per annum on diminishing balance method. Write off further Credit losses amounting to R2 000. Adjust Allowances for credit losses to 5% of Debtors. Provide for the outstanding interest on loan at 10% per annum. A final dividend of R14 000 was declared on 31 December 2020. income taxation expense for the year amounted to R40 000. (1) (2) (3) (4) (5) (6) (7) REQUIRED: Prepare a Statement of Comprehensive Income for TTM Ltd for the year ended 31 December 2020 in compliance to the General Accepted Accounting Practices (GAAP). Comparative figures and notes are not required.

Step by Step Solution

3.35 Rating (155 Votes )

There are 3 Steps involved in it

TTM Ltd Statement of Comprehensive income for the Year ended December 31 2020 Revenues R R Sales 539... View full answer

Get step-by-step solutions from verified subject matter experts