Question: A study guide I need help with by getting it answered. Question 6 of 10 -/16 = v Policies Current Attempt in Progress Atthe end

A study guide I need help with by getting it answered.

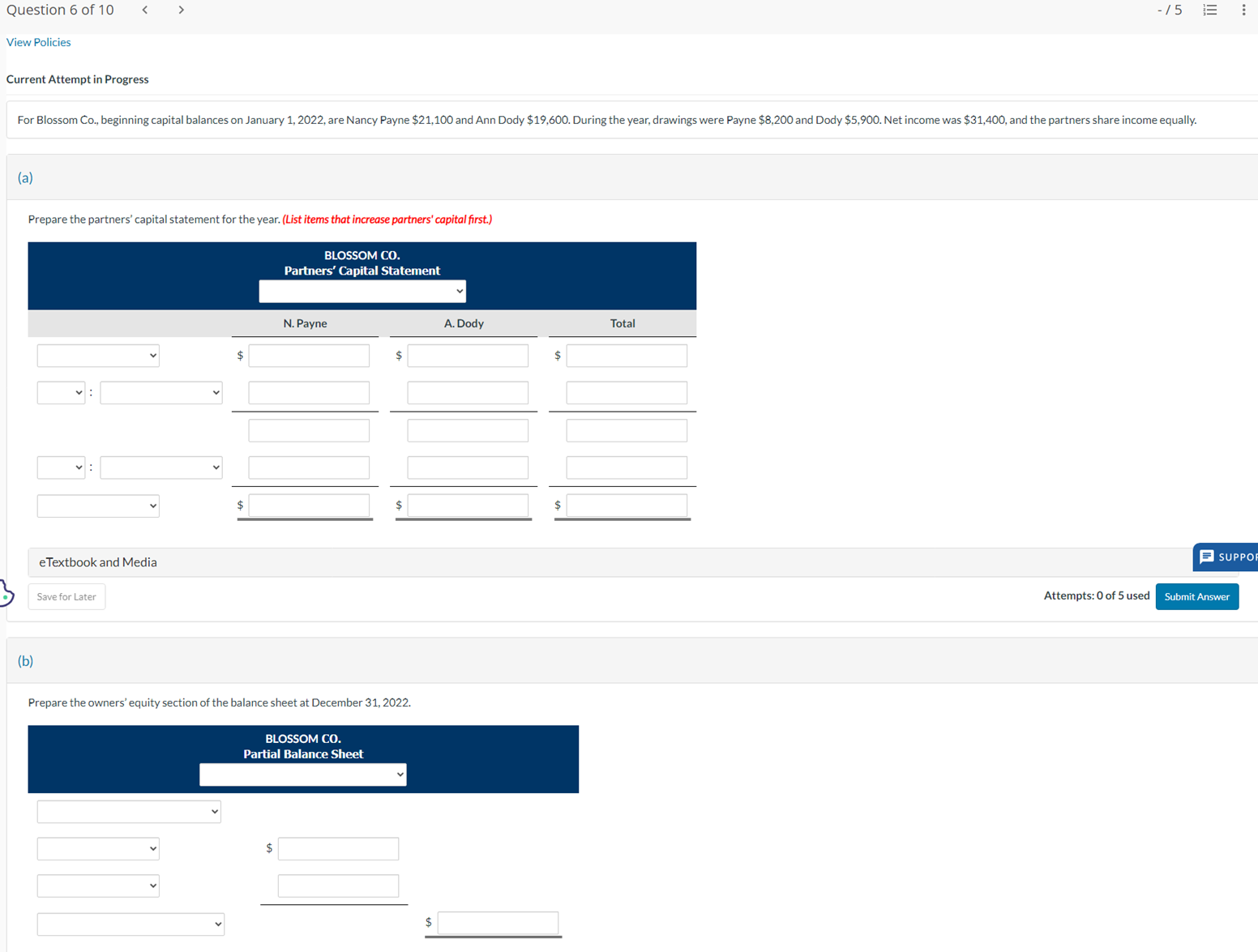

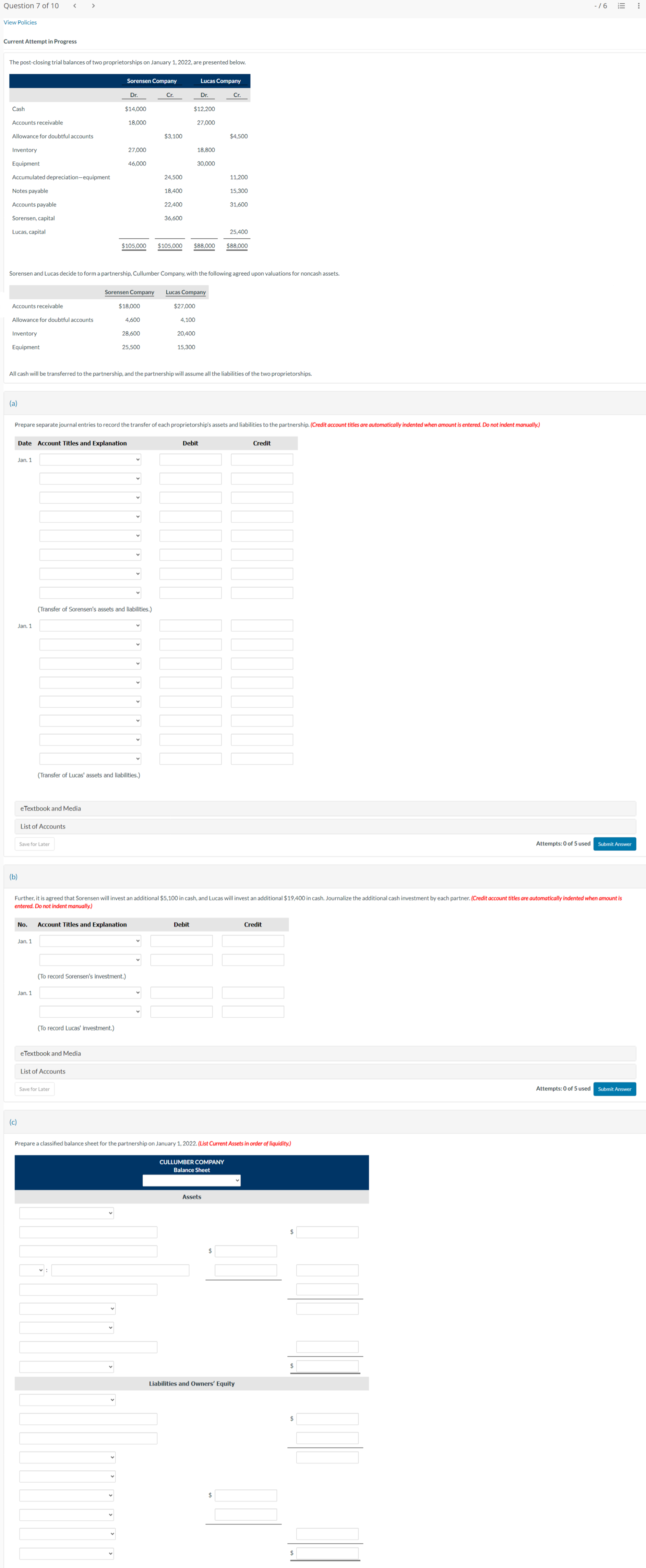

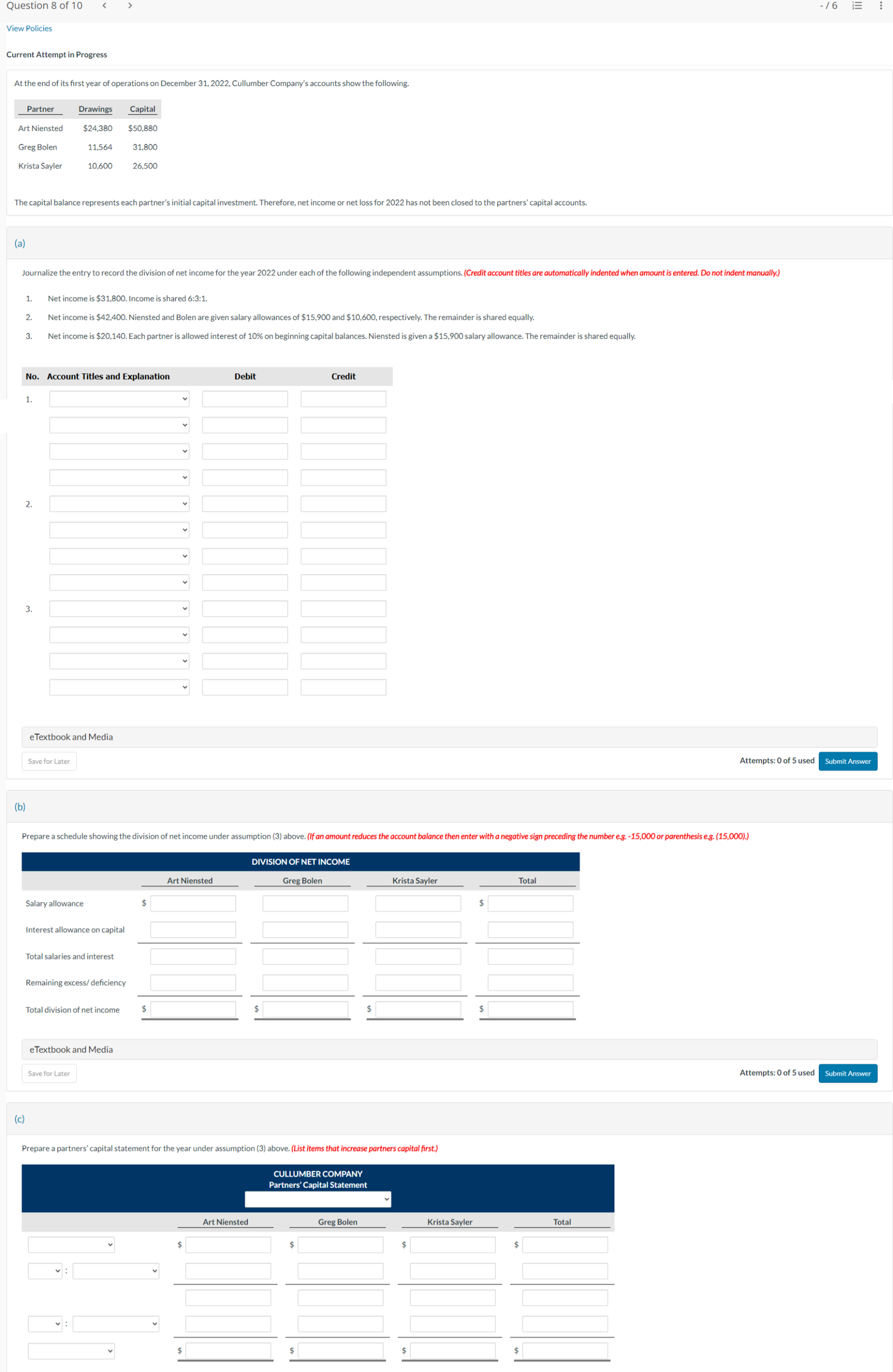

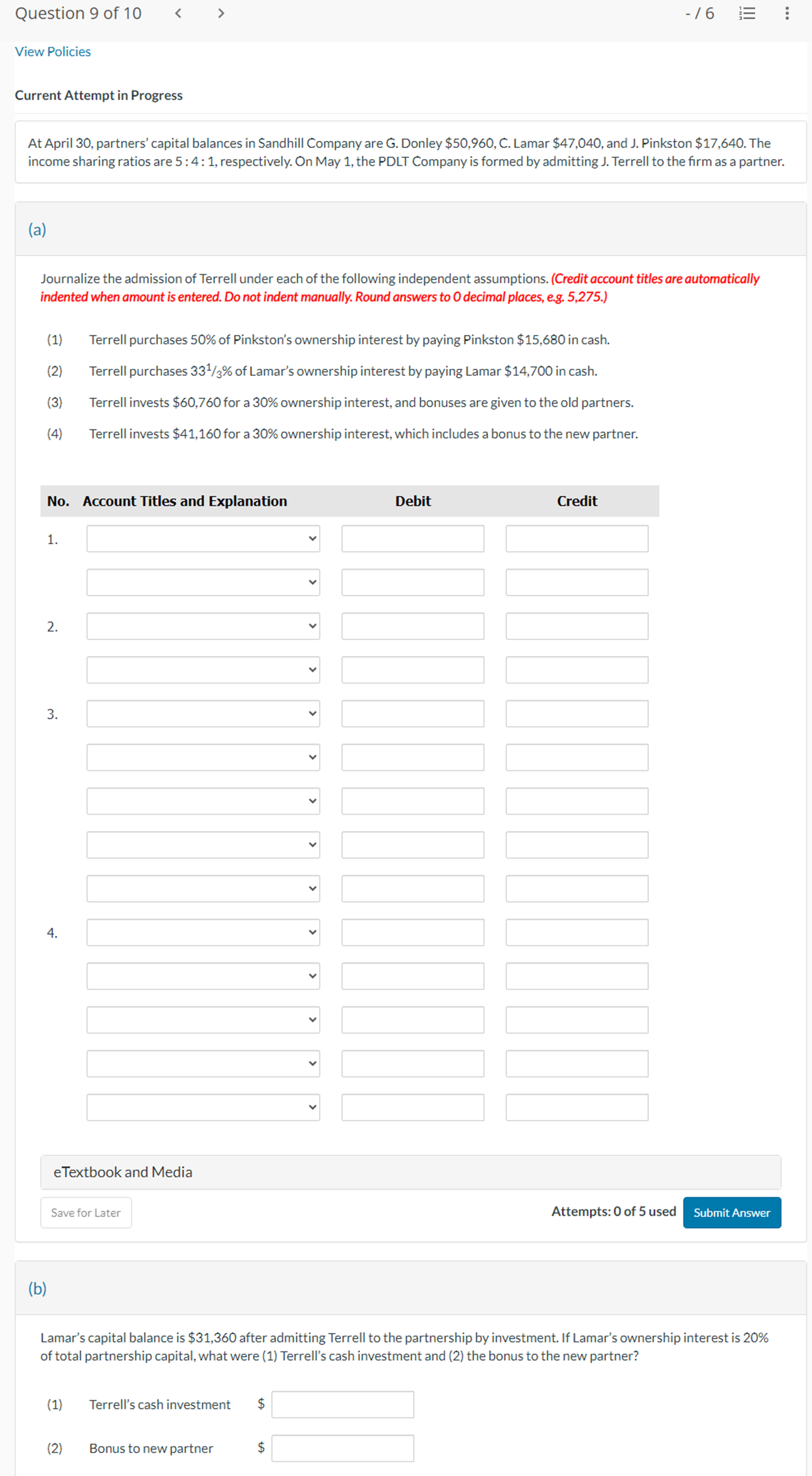

Question 6 of 10 -/16 = v Policies Current Attempt in Progress Atthe end of its first year of operations on December 31, 2022, Cullumber Company's accounts show the following. Partner Drawings Capital ArtNiensted $24380 $50.880 GregBolen 11564 31800 Krista Sayler 10,600 26,500 The capital balance represents each partner's initial capital investment. Therefore, net income or net loss for 2022 has not been closed to the partners' capital accounts. (a) Journalize the entry to record the division of net income for the year 2022 under each of the following independent assumptions. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) 1. Net income is $31,800. Income is shared 6:3:1. 2. Net income is $42.400. Niensted and Bolen are given salary allowances of $15,200 and $10,600, respectively. The remainder is shared equally. 3. Net income is $20,140. Each partner is allowed interest of 10% on beginning capital balances. Niensted is given a $15,900 salary allowance. The remainder is shared equally. No. Account Titles and Explanation Debit Credit 1 b 2 v 3. v eTextbook and Media (b) Prepare a schedule showing the division of net income under assumption (3) above. (If an amount reduces the account balance then enter with a negative sign preceding the number e.g. -15,000 or parenthesis eg. (15,000).) DIVISION OF NET INCOME Art Niensted Greg Bolen Krista Sayler Total Salary allowance $ $ Interest allowance on capital Total salaries and interest Remaining excess/ deficiency Total division of net income $ $ $ $ Textbook and Media Attempts: 0of Sused [N (c) Prepare a partners' capital statement for the year under assumption (3) above. (List items that increase partners capiltal first.) CULLUMBER COMPANY Lot e e Art Niensted Greg Bolen Krista Sayler Total Question 9 of 10 - 16 View Policies Current Attempt in Progress At April 30, partners' capital balances in Sandhill Company are G. Donley $50,960, C. Lamar $47,040, and J. Pinkston $17,640. The income sharing ratios are 5: 4: 1, respectively. On May 1, the PDLT Company is formed by admitting J. Terrell to the firm as a partner. (a) Journalize the admission of Terrell under each of the following independent assumptions. (Credit account titles are automatically indented when amount is entered. Do not indent manually. Round answers to O decimal places, e.g. 5,275.) (1) Terrell purchases 50% of Pinkston's ownership interest by paying Pinkston $15,680 in cash. (2) Terrell purchases 331/3% of Lamar's ownership interest by paying Lamar $14,700 in cash. (3) Terrell invests $60,760 for a 30% ownership interest, and bonuses are given to the old partners. (4) Terrell invests $41,160 for a 30% ownership interest, which includes a bonus to the new partner. No. Account Titles and Explanation Debit Credit 1. 2. 3. 4. e Textbook and Media Save for Later Attempts: 0 of 5 used Submit Answer (b) Lamar's capital balance is $31,360 after admitting Terrell to the partnership by investment. If Lamar's ownership interest is 20% of total partnership capital, what were (1) Terrell's cash investment and (2) the bonus to the new partner? (1) Terrell's cash investment $ (2) Bonus to new partner $Question 10 of 10 -/16 = View Policies Current Attempt in Progress On December 31, the capital balances and income ratios in Sheridan Company are as follows. Partner Capital Balance Income Ratio Trayer $59,500 50% Emig 35,500 30% Posada 30,500 20% (@) Journalize the withdrawal of Posada under each of the following assumptions. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) (1) Each of the continuing partners agrees to pay $18,600 in cash from personal funds to purchase Posada's ownership equity. Each receives 50% of Posada's equity. (2) Emig agrees to purchase Posada's ownership interest for $23,000 cash. 3) Posada is paid $34,100 from partnership assets, which includes a bonus to the retiring partner. (4) Posada is paid $20,980 from partnership assets, and bonuses to the remaining partners are recognized. No. Account Titles and Explanation Debit Credit eTextbook and Media Save for Later Attempts: 0 of 5 used (b) If Emig's capital balance after Posada's withdrawal is $38,890, what were (1) the total bonus to the remaining partners and (2) the cash paid by the partnership to Posada? (1) Total bonus $ (2) Cash paid to Posada $ View Policies on respects an capital boland retirement of Michael. how much partnership casts should move to be paid to Michael for her partnership O Any amour unt gold to Michael will cause Lagassi and Kely to sel have equal capital balances. profits and losses as follows As salaries S COPSES as interest on capital at the Remaining profits or losses allocation to Dickens? O $8400 loms The partnership agreement of Paul and Cohen provides for salary alowances decrease more than Cacheris Question 4 of 20 whochapter'S' corporation. O Irrited labalty company. Question 5 of 20 view Policies Current Attempt in Progress $103100, and King. Capital $2560. The income $300809 question 6 of 20 Whew Policies Current Attempt in Progress admission into the organization Before this transaction Kevin and Hein show show a debit to Cash for $282400. not show a debit to cash 41200. stion 7 of 20 Carla Vista Jerr CARLA VISTA, JENNINGS, AND BLAIR PARTNERSHIP December 31. 2020 $ 45300 Noncash assess 290900 90300 Fair. Capital 29800 5325300 Tot $325 106 The personal assets of Partner Meant to personal musets of Partners Carla Vista and Bait. The personal assets of Parteers Carla Vista Jennings and Blax. Question 8 of 20 View Policies Current Attempt in Progress amount after tens hom been admitted asa partner, by penis $95.00 O could have been adreitted by an investment of assets one of a partner's letter mant haws been admitted by purchase of a partner's interest. stion 9 of 20 trent Attempt in Progress In the liquidation of a partnership, any partner who has a capital deficiency wartomatically ter reinated an a partner is not obligated to make up the capital sen Ciency will receive a cash distribution only on the basis of his or her Income-sharing ratio. on 10 of 20 suratfree and Termeny formed a partnership with income sharing ratios of 50%%, 30%%, and 20% resp Arnie's capital balance was 5152000. and Tammy had a capital deficiency of $61000. Assuming Tamerey corte Buses cash to match her 5129125. $170875, Question 11 of 20 In the Squidation process. if a capital account shows a deficiency O * has disregarded units after the partnership books I can be written off toa"Gain' account estion 12 of 20

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts