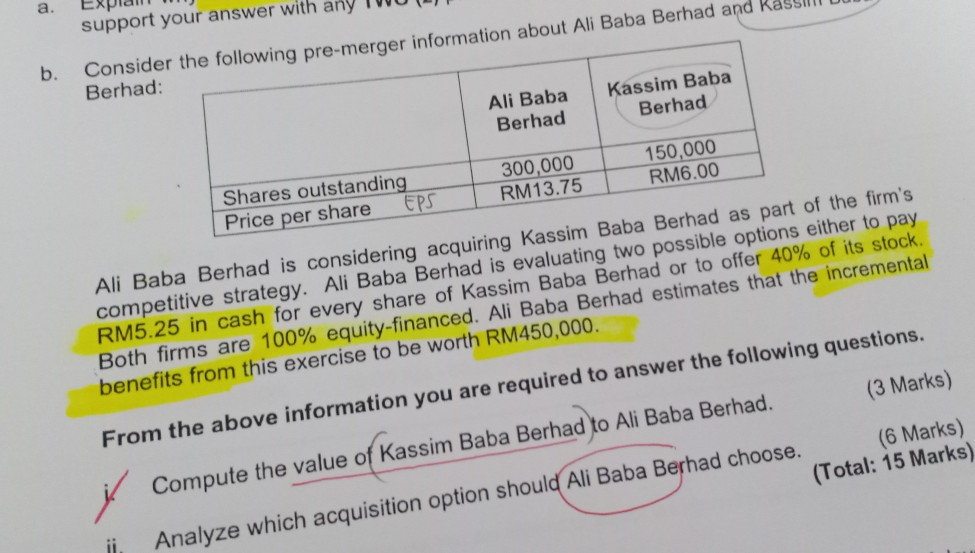

Question: a. support your answer with any Consider the following pre-merger information about Ali Baba Berhad and Berhad: b. Ali Baba Berhad Kassim Baba Berhad 300,000

a. support your answer with any Consider the following pre-merger information about Ali Baba Berhad and Berhad: b. Ali Baba Berhad Kassim Baba Berhad 300,000 RM13.75 150,000 RM6.00 Shares outstanding Price per share EPS Ali Baba Berhad is considering acquiring Kassim Baba Berhad as part of the firm's competitive strategy. Ali Baba Berhad is evaluating two possible options either to pay RM5.25 in cash for every share of Kassim Baba Berhad or to offer 40% of its stock. Both firms are 100% equity-financed. Ali Baba Berhad estimates that the incremental benefits from this exercise to be worth RM450,000 From the above information you are required to answer the following questions. Compute the value of Kassim Baba Berhad to Ali Baba Berhad. (3 Marks) Analyze which acquisition option should Ali Baba Berhad choose. (6 Marks) (Total: 15 Marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts