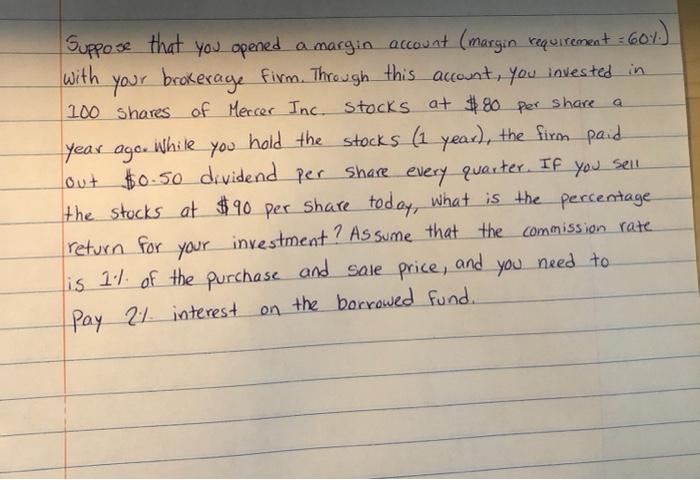

Question: = a Suppose that you opened a margin account (margin requirement -60% 60%) with your brokerage firm. Through this account, you invested in . 100

= a Suppose that you opened a margin account (margin requirement -60% 60%) with your brokerage firm. Through this account, you invested in . 100 shares of Mercer Inc. stocks at $80 per share year ago. While you hold the stocks (1 year), the firm paid . out $0.50 dividend per share every quarter. If you sell the stocks at $90 per share today, what is the percentage return for your investment ? Assume that the commission rate is it of the purchase and sale price, and you pay 21 interest on the borrowed fund. need to

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock