Question: Please show all work! Please answer both questions 2. Suppose that you opened a margin account (margin requirement 60%) with your brokerage firm Through this

Please show all work!

Please answer both questions

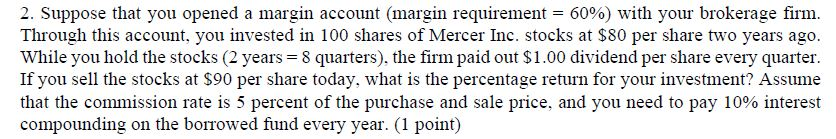

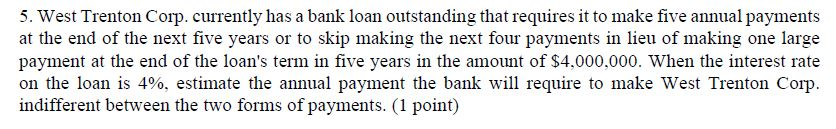

2. Suppose that you opened a margin account (margin requirement 60%) with your brokerage firm Through this account, you invested in 100 shares of Mercer Inc. stocks at $80 per share two years ago. While you hold the stocks (2 years 8 quarters), the firm paid out $1.00 dividend per share every quarter. If you sell the stocks at $90 per share today, what is the percentage return for your investment? Assume that the commission rate is 5 percent of the purchase and sale price, and you need to pay 10% interest compounding on the borrowed fund every year. (1 point) 5. West Trenton Corp. currently has a bank loan outstanding that requires it to make five annual payments at the end of the next five years or to skip making the next four payments in lieu of making one large payment at the end of the loan's term in five years in the amount of $4,000.000. When the interest rate indifferent between the two forms of payments. (1 point)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts