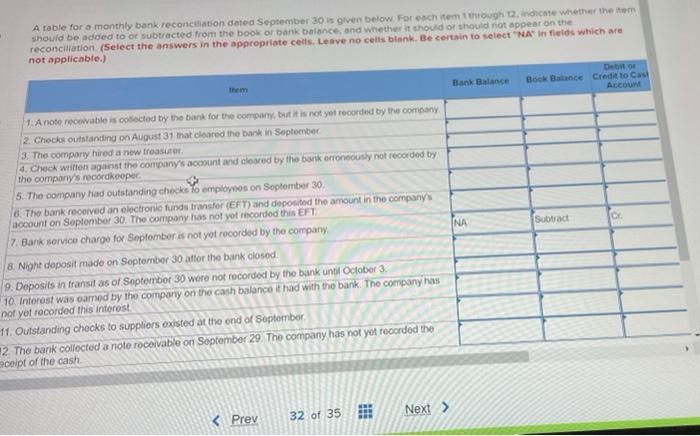

Question: A table for a monthly bank reconciliation dated September 30 is given below. For each item through 2, indicate whether the item should be added

A table for a monthly bank reconciliation dated September 30 is given below. For each item through 2, indicate whether the item should be added to or subtracted from the book or bank balance, and whether it should or should not appear on the reconciliation (Select the answers in the appropriate cells. Leave no cells blank. Be certain to select "NA" In fields which are not applicable) Bank Balance De Book Balance Credit to Cast Account Item Subtract C NA 1. A not receivable is coniected by the bank for the company, but it is not yet recorded by the company 2. Check outstanding on August 31 that cleared the bank in September 3. The company hired a new treasure 4. Check written against the company's account and cleared by the bank erroneously not recorded by the company's recordkooper 5. The company had outstanding checks to employees on Soptember 30 6. The bank received an electronic funds transfor (EFT) and deposited the amount in the company's account on September 30. The company has not yot recorded this EFT 7. Bank service charge for September is not yot recorded by the company 8. Night deposit made on September 30 after the bank closed. 9. Deposits in transit as of September 30 were not recorded by the bank until October 3. 10. Interest was earned by the company on the cash balance it had with the bank. The company has not yet recorded this interest 11. Outstanding chocks to suppliers existed at the end of September 2. The bank colloctod a note receivable on September 29. The company has not yet recorded the aceipt of the cash Next

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts