Question: A tax return problem. Using the preceding information, complete 1120-S, 1125-A, Schedule D, Schedules K-1, and Form 8949 for Tin Cup, Inc. n- I u-

A tax return problem.

Using the preceding information, complete 1120-S, 1125-A, Schedule D, Schedules K-1, and Form 8949 for Tin Cup, Inc.

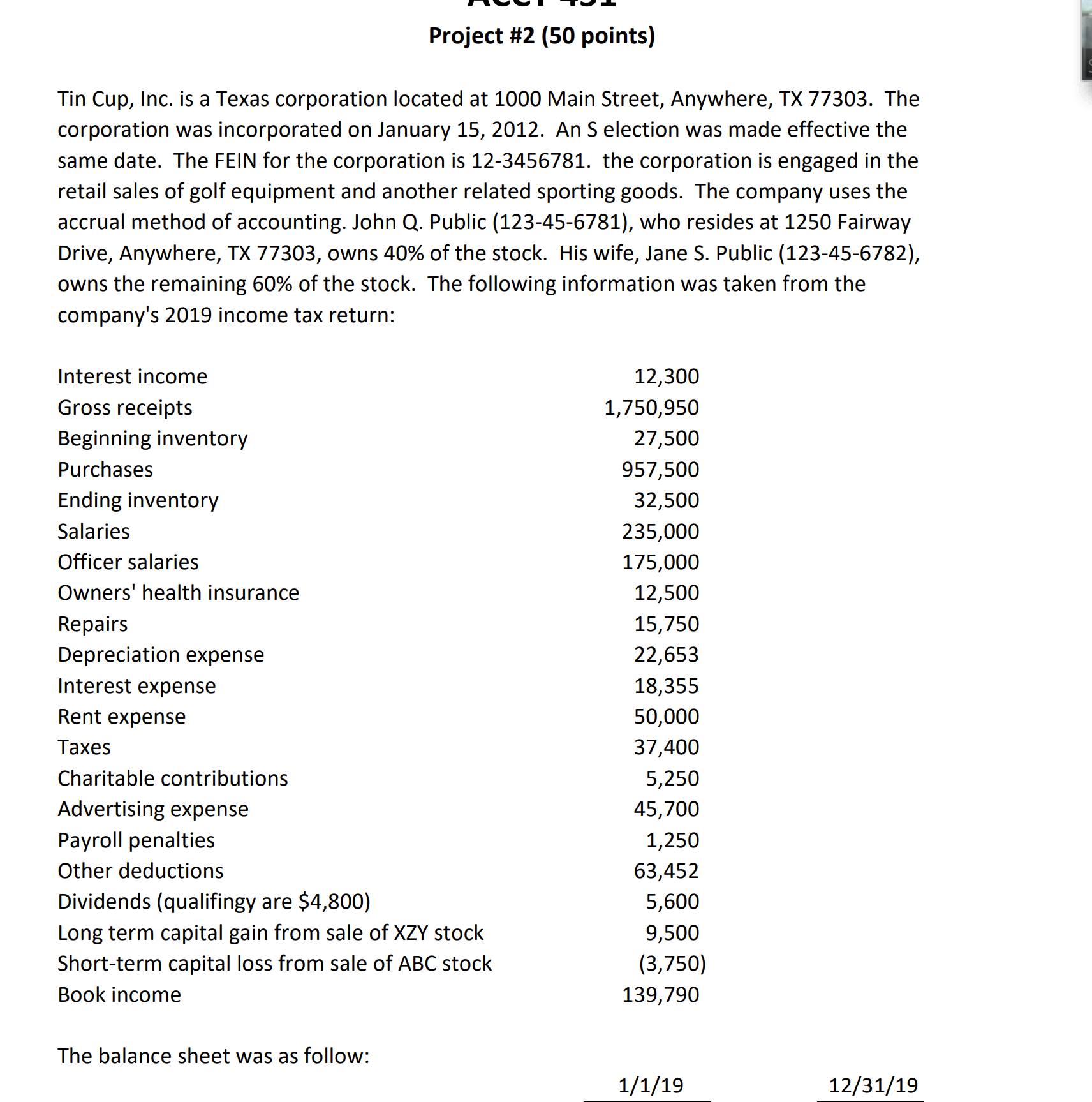

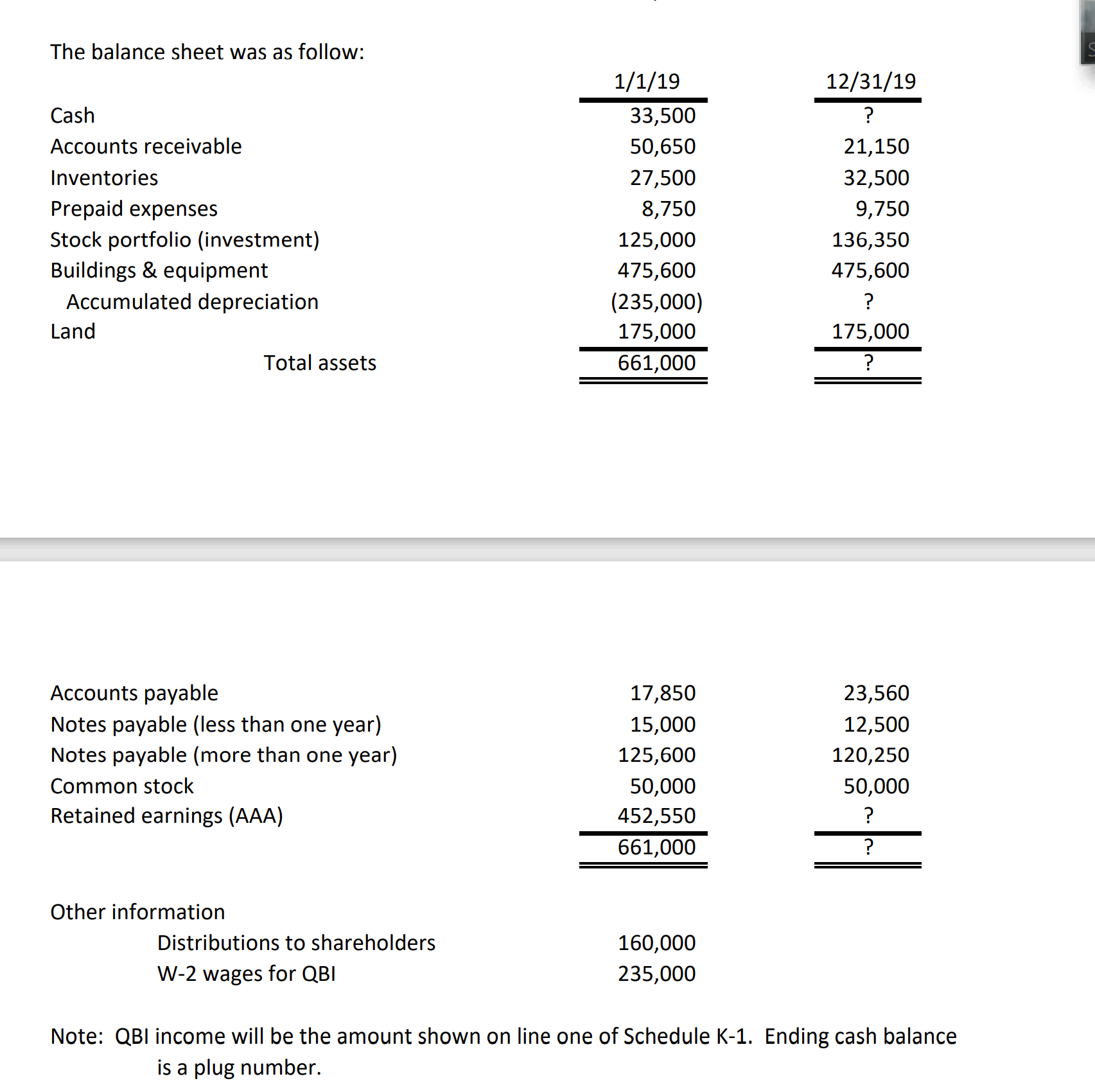

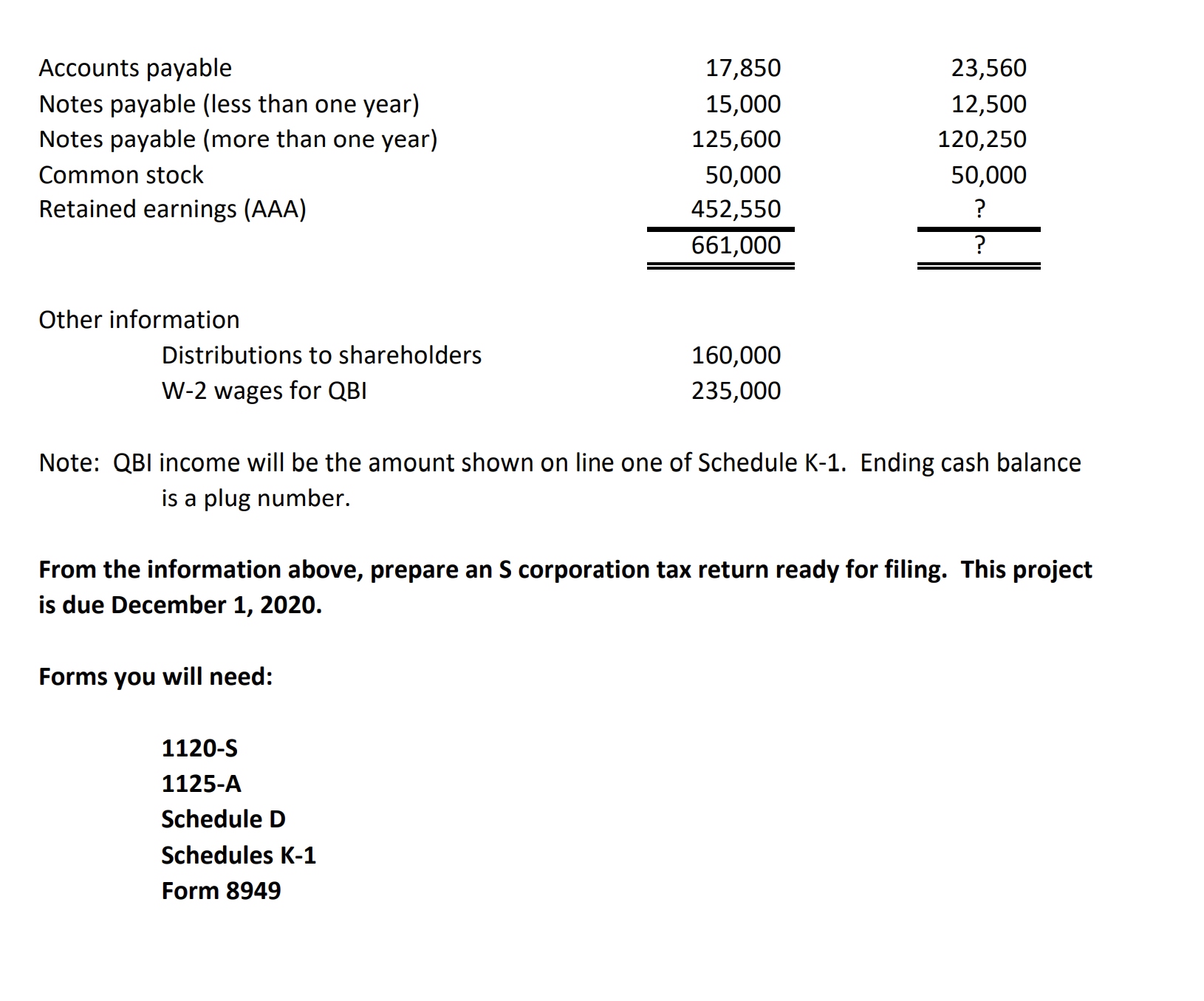

n\"- I u- Project #2 (50 points) Tin Cup, Inc. is a Texas corporation located at 1000 Main Street, Anywhere, TX 77303. The corporation was incorporated on January 15, 2012. An 5 election was made effective the same date. The FEIN for the corporation is 12-3456781. the corporation is engaged in the retail sales of golf equipment and another related sporting goods. The company uses the accrual method of accounting. John (1. Public (123-45-6781), who resides at 1250 Fairway Drive, Anywhere, TX 77303, owns 40% of the stock. His wife, Jane 5. Public (123-45-6782), owns the remaining 60% of the stock. The following information was taken from the company's 2019 income tax return: Interest income 12,300 Gross receipts 1,750,950 Beginning inventory 27,500 Purchases 957,500 Ending inventory 32,500 Salaries 235,000 Officer salaries 175,000 Owners' health insurance 12,500 Repairs 15,750 Depreciation expense 22,653 Interest expense 18,355 Rent expense 50,000 Taxes 37,400 Charitable contributions 5,250 Advertising expense 45,700 Payroll penalties 1,250 Other deductions 63,452 Dividends (qualifingy are $4,800) 5,600 Long term capital gain from sale of XZY stock 9,500 Short-term capital loss from sale of ABC stock (3,750) Book income 139,790 The balance sheet was as follow: 1/1/19 12/31/19 The balance sheet was as follow: 1/1/19 12/31/19 Cash 33,500 ? Accounts receivable 50,650 21,150 Inventories 27,500 32,500 Prepaid expenses 8,750 9,750 Stock portfolio (investment) 125,000 136,350 Buildings & equipment 475,600 475,600 Accumulated depreciation (235,000) ? Land 175,000 175,000 Total assets 661,000 ? Accounts payable 17,850 23,560 Notes payable (less than one year) 15,000 12,500 Notes payable (more than one year) 125,600 120,250 Common stock 50,000 50,000 Retained earnings (AAA) 452,550 ? 661,000 ? Other information Distributions to shareholders 160,000 W-2 wages for QBI 235,000 Note: QBI income will be the amount shown on line one of Schedule K-1. Ending cash balance is a plug number. Accounts payable 17,850 23,560 Notes payable (less than one year) 15,000 12,500 Notes payable (more than one year) 125,600 120,250 Common stock 50,000 50,000 Retained earnings (AAA) 452,550 ? 661,000 ? Other information Distributions to shareholders 160,000 W-2 wages for QBI 235,000 Note: QBI income will be the amount shown on line one of Schedule K-1. Ending cash balance is a plug number. From the information above, prepare an S corporation tax return ready for filing. This project is due December 1, 2020. Forms you will need: 1120-5 1125-A Schedule D Schedules K-1 Form 8949