Question: a. The 7.6%, five-year bond yields 5.7%. If this yield to maturity remains unchanged, what will be its price one year hence? Assume annual coupon

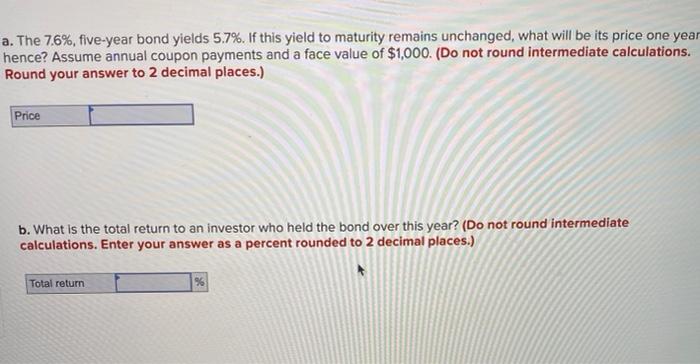

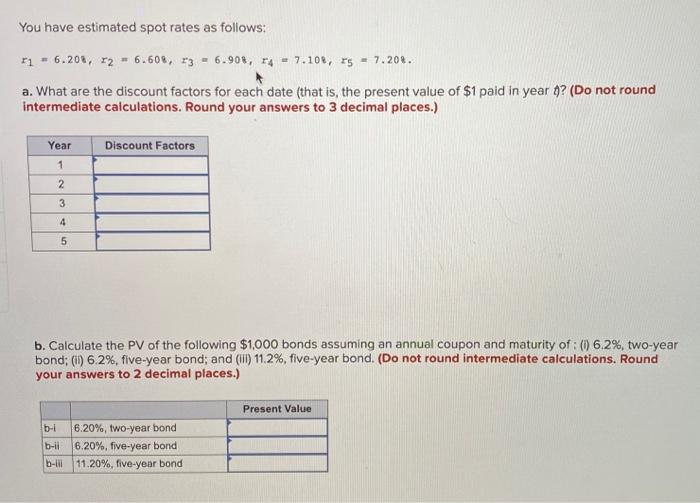

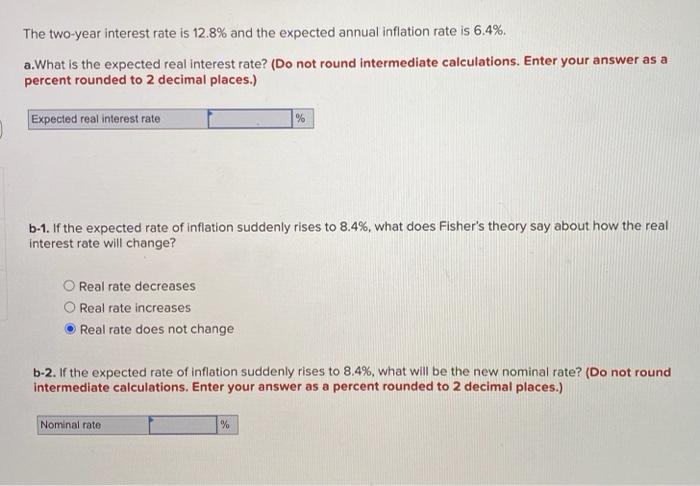

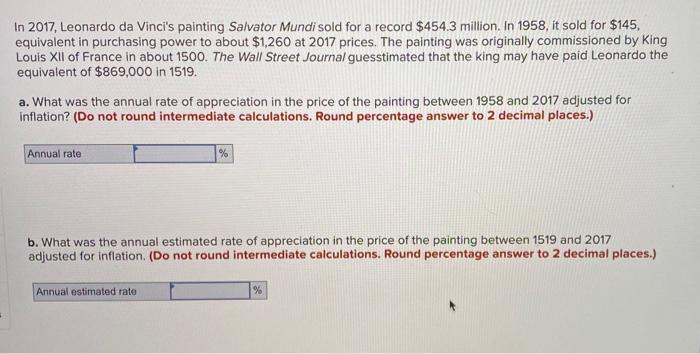

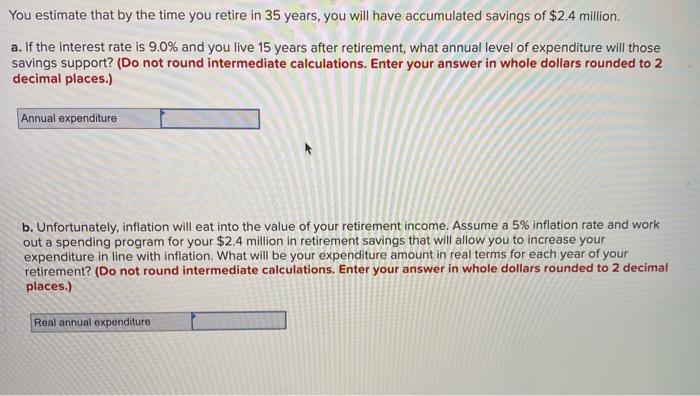

a. The 7.6%, five-year bond yields 5.7%. If this yield to maturity remains unchanged, what will be its price one year hence? Assume annual coupon payments and a face value of $1,000. (Do not round intermediate calculations. Round your answer to 2 decimal places.) Price b. What is the total return to an investor who held the bond over this year? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) Total return You have estimated spot rates as follows: r1 = 6.208, r2 = 6.608, F3 = 6.90, r4 = 7.108, r5 = 7.204. a. What are the discount factors for each date (that is, the present value of $1 paid in year ? (Do not round intermediate calculations. Round your answers to 3 decimal places.) Discount Factors Year 1 2 3 4 5 b. Calculate the PV of the following $1,000 bonds assuming an annual coupon and maturity of : (0) 6.2%, two-year bond: (1) 6.2%, five-year bond; and (III) 11.2%, five-year bond. (Do not round Intermediate calculations. Round your answers to 2 decimal places.) Present Value b-1 b-il b- 6.20%, two-year bond 6.20%, five-year bond 11.20%, five-year bond The two-year interest rate is 12.8% and the expected annual inflation rate is 6.4%. a.What is the expected real interest rate? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) Expected real interest rate % b-1. If the expected rate of inflation suddenly rises to 8.4%, what does Fisher's theory say about how the real interest rate will change? Real rate decreases Real rate increases Real rate does not change b-2. If the expected rate of inflation suddenly rises to 8.4%, what will be the new nominal rate? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) Nominal rate % In 2017, Leonardo da Vinci's painting Salvator Mundi sold for a record $454.3 million. In 1958, it sold for $145, equivalent in purchasing power to about $1,260 at 2017 prices. The painting was originally commissioned by King Louis XII of France in about 1500. The Wall Street Journal guesstimated that the king may have paid Leonardo the equivalent of $869,000 in 1519. a. What was the annual rate of appreciation in the price of the painting between 1958 and 2017 adjusted for inflation? (Do not round intermediate calculations. Round percentage answer to 2 decimal places.) Annual rate % b. What was the annual estimated rate of appreciation in the price of the painting between 1519 and 2017 adjusted for Inflation. (Do not round intermediate calculations. Round percentage answer to 2 decimal places.) Annual estimated rate % You estimate that by the time you retire in 35 years, you will have accumulated savings of $2.4 million. a. If the interest rate is 9.0% and you live 15 years after retirement, what annual level of expenditure will those savings support? (Do not round intermediate calculations. Enter your answer in whole dollars rounded to 2 decimal places.) Annual expenditure b. Unfortunately, inflation will eat into the value of your retirement income. Assume a 5% inflation rate and work out a spending program for your $2.4 million in retirement savings that will allow you to increase your expenditure in line with inflation. What will be your expenditure amount in real terms for each year of your retirement? (Do not round intermediate calculations. Enter your answer in whole dollars rounded to 2 decimal places.) Real annual expenditure

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts