Question: Trey has two dependents, his daughters, ages 14 and 18, at year-end. Trey files a joint return with his spouse. What amount of child

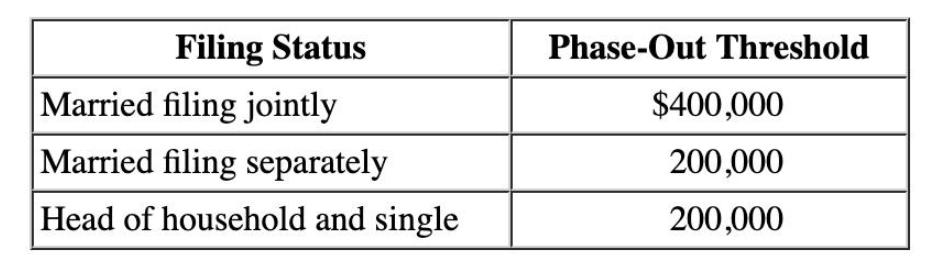

Trey has two dependents, his daughters, ages 14 and 18, at year-end. Trey files a joint return with his spouse. What amount of child tax credit (either as a child or a qualifying dependent) will Trey be able to claim in 2022 for his daughters under each of the following alternative situations? Use Exhibit 8-8. Required: a. His AGI is $106,900. b. His AGI is $443,000. c. His AGI is $422,400, and his daughters are ages 10 and 12. Filing Status Married filing jointly Married filing separately Head of household and single Phase-Out Threshold $400,000 200,000 200,000

Step by Step Solution

There are 3 Steps involved in it

Part A Amount of child tax credit 3500 Treys AGI is 106900 which is less than phaseout threshold 400... View full answer

Get step-by-step solutions from verified subject matter experts