Question: Lacy is a single taxpayer. In 2022, her taxable income is $47,200. What is her tax liability in each of the following alternative situations?

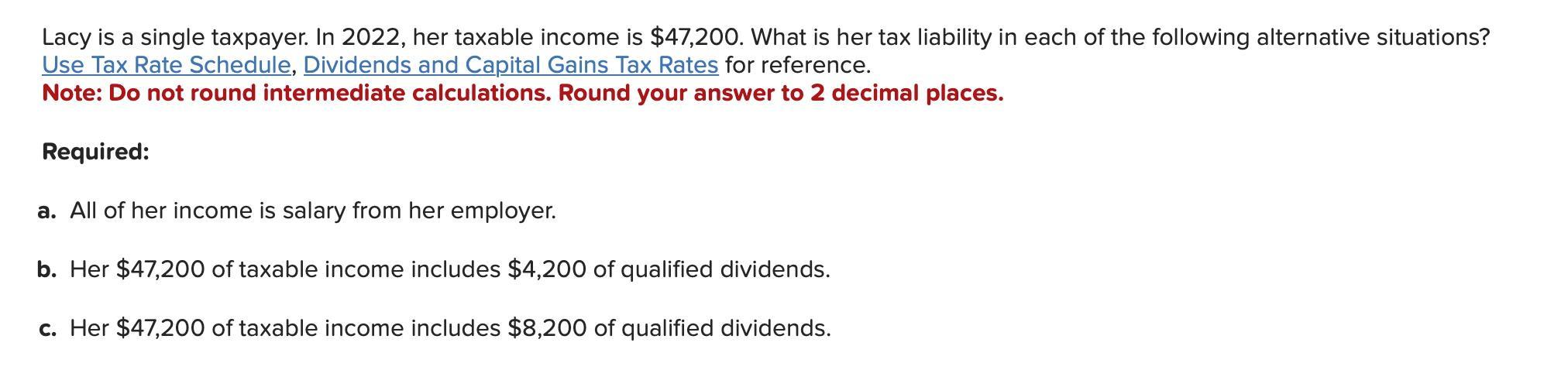

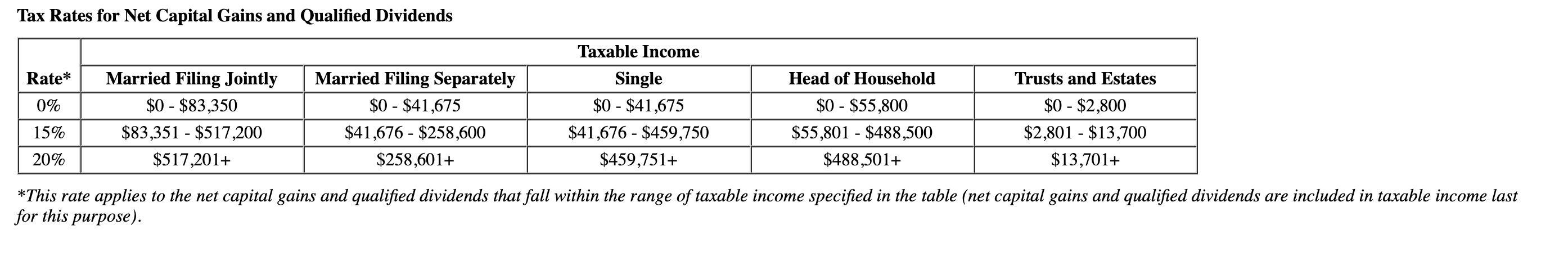

Lacy is a single taxpayer. In 2022, her taxable income is $47,200. What is her tax liability in each of the following alternative situations? Use Tax Rate Schedule, Dividends and Capital Gains Tax Rates for reference. Note: Do not round intermediate calculations. Round your answer to 2 decimal places. Required: a. All of her income is salary from her employer. b. Her $47,200 of taxable income includes $4,200 of qualified dividends. c. Her $47,200 of taxable income includes $8,200 of qualified dividends. Tax Rates for Net Capital Gains and Qualified Dividends Rate* 0% 15% 20% Married Filing Jointly $0-$83,350 $83,351 - $517,200 $517,201+ Married Filing Separately $0-$41,675 $41,676 $258,600 Taxable Income $258,601+ Single $0-$41,675 $41,676 $459,750 Head of Household $0-$55,800 $55,801 - $488,500 $488,501+ Trusts and Estates $0-$2,800 $2,801 - $13,700 $13,701+ $459,751+ *This rate applies to the net capital gains and qualified dividends that fall within the range of taxable income specified in the table (net capital gains and qualified dividends are included in taxable income last for this purpose).

Step by Step Solution

3.41 Rating (167 Votes )

There are 3 Steps involved in it

ANSWER To calculate Lacys tax liability in each situation we need to determine the applicable tax rates based on her taxable income and the type of in... View full answer

Get step-by-step solutions from verified subject matter experts