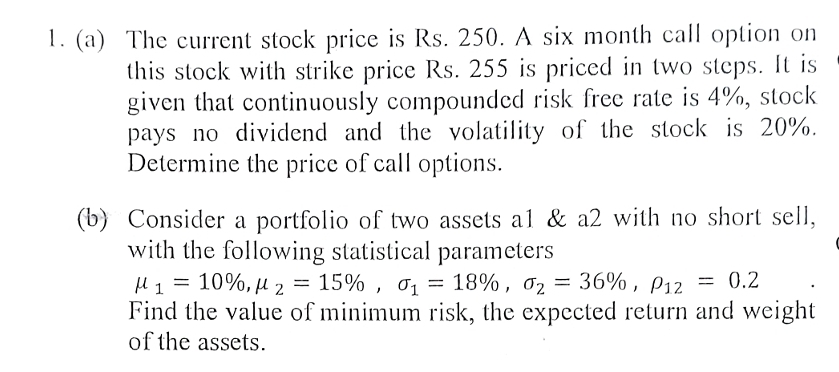

Question: ( a ) The current stock price is Rs . 2 5 0 . A six month call option on this stock with strike price

a The current stock price is Rs A six month call option on this stock with strike price Rs is priced in two steps. It is given that continuously compounded risk free rate is stock pays no dividend and the volatility of the stock is Determine the price of call options.

b Consider a portfolio of two assets a & a with no short sell, with the following statistical parameters

Find the value of minimum risk, the expected return and weight of the assets.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock