Question: a. the project should be accepted b. the project should be rejected c. the project should be either rejected or accepted d. there is not

a. the project should be accepted

b. the project should be rejected

c. the project should be either rejected or accepted

d. there is not enough information to determine

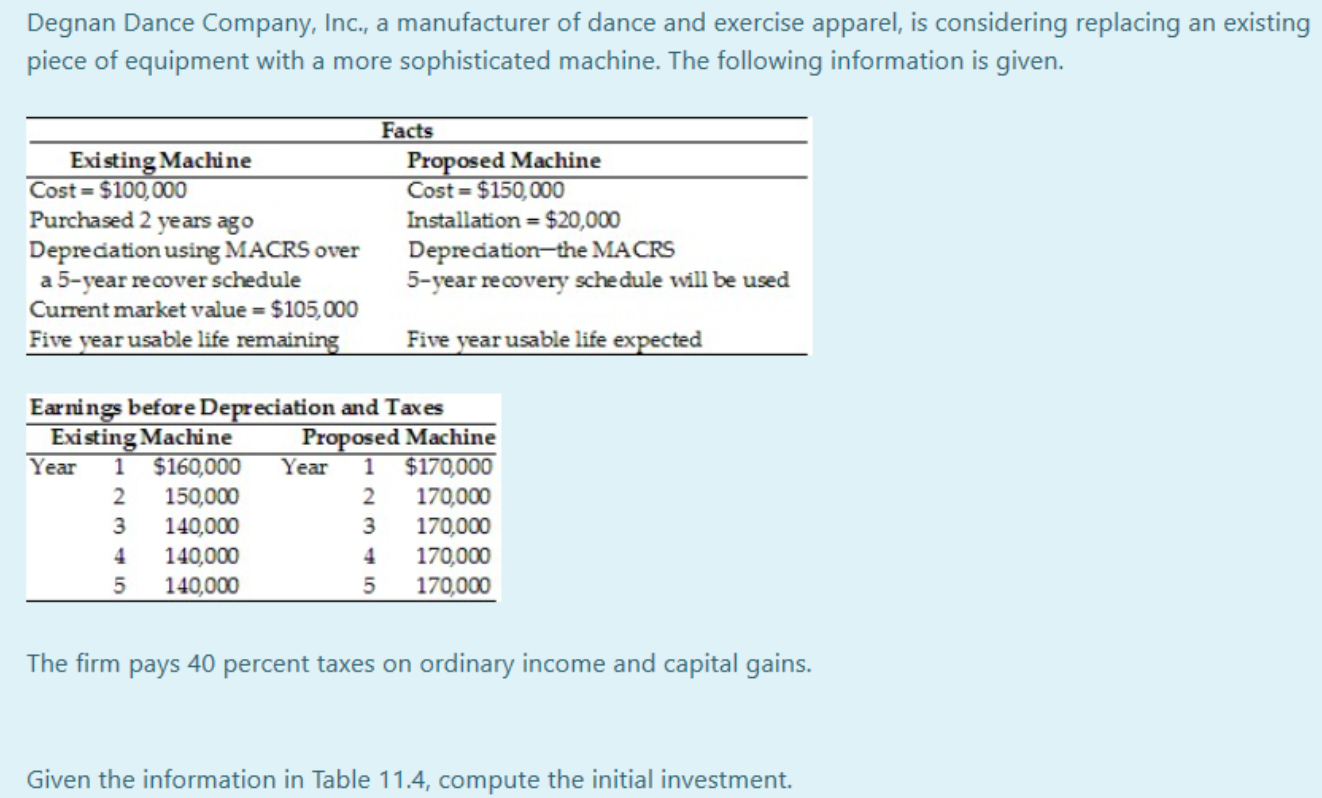

Degnan Dance Company, Inc., a manufacturer of dance and exercise apparel, is considering replacing an existing piece of equipment with a more sophisticated machine. The following information is given. Existing Machine Cost = $100,000 Purchased 2 years ago Depreciation using MACRS Over a 5-year recover schedule Current market value = $ 105,000 Five year usable life remaining Facts Proposed Machine Cost = $150,000 Installation = $20,000 Depreciation-the MACRS 5-year recovery schedule will be used Five year usable life expected Earnings before Depreciation and Taxes Existing Machine Proposed Machine Year 1 $160,000 Year 1 $170,000 2. 150,000 2 170,000 3 140,000 3 170,000 4 140,000 4 170,000 5 140,000 5 170,000 The firm pays 40 percent taxes on ordinary income and capital gains. Given the information in Table 11.4, compute the initial investment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts