Question: A thumbs up will be given to the correct answer, it is promised :) Presented below is the comparative balance sheet for Pharoah Inc., a

A thumbs up will be given to the correct answer, it is promised :)

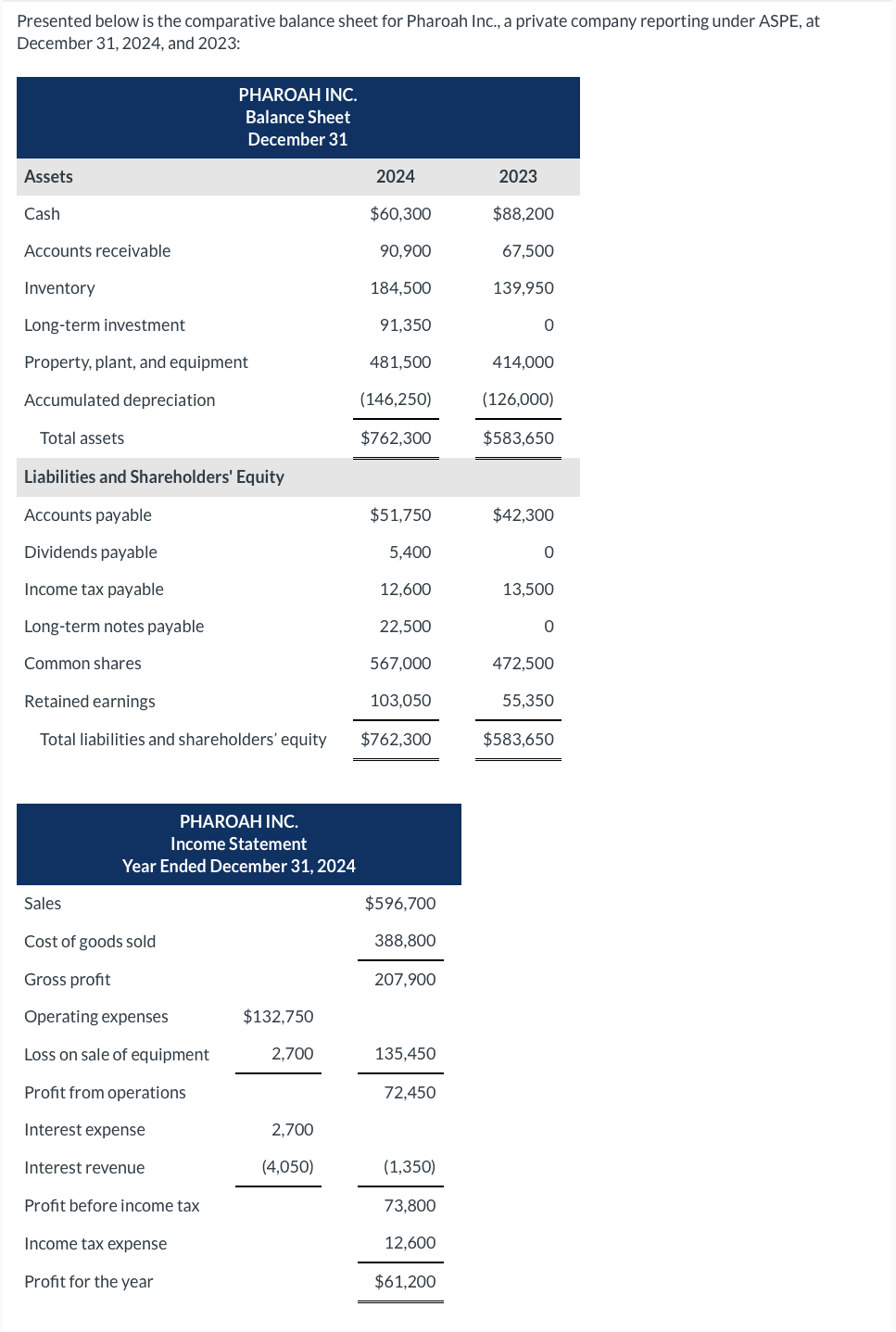

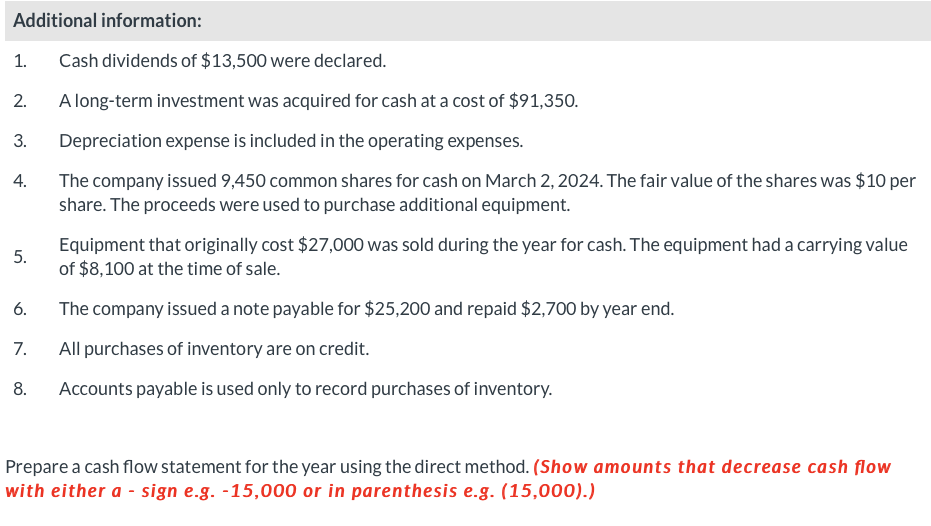

Presented below is the comparative balance sheet for Pharoah Inc., a private company reporting under ASPE, at December 31, 2024, and 2023: 1. Cash dividends of $13,500 were declared. 2. A long-term investment was acquired for cash at a cost of $91,350. 3. Depreciation expense is included in the operating expenses. 4. The company issued 9,450 common shares for cash on March 2,2024 . The fair value of the shares was $10 per share. The proceeds were used to purchase additional equipment. 5. Equipment that originally cost $27,000 was sold during the year for cash. The equipment had a carrying value of $8,100 at the time of sale. 6. The company issued a note payable for $25,200 and repaid $2,700 by year end. 7. All purchases of inventory are on credit. 8. Accounts payable is used only to record purchases of inventory. Prepare a cash flow statement for the year using the direct method. (Show amounts that decrease cash flow with either a - sign e.g. - 15,000 or in parenthesis e.g. (15,000).) PHAROAHINC. Cash Flow Statement - Direct Method $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts