Question: A. TRUE / FALSE QUESTIONS Enter True or False on the blank preceding each question. 1. The majority of businesses in the United States are

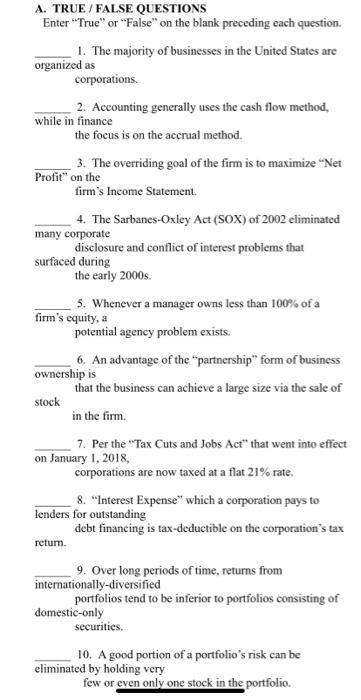

A. TRUE / FALSE QUESTIONS Enter "True" or "False" on the blank preceding each question. 1. The majority of businesses in the United States are organized as corporations 2. Accounting generally uses the cash flow method, while in finance the focus is on the accrual method. 3. The overriding goal of the firm is to maximize "Net Profit" on the firm's Income Statement. 4. The Sarbanes-Oxley Act (SOX) of 2002 eliminated many corporate disclosure and conflict of interest problems that surfaced during the early 2000s. 5. Whenever a manager owns less than 100% of a firm's equity, a potential agency problem exists. 6. An advantage of the "partnership" form of business ownership is that the business can achieve a large size via the sale of stock in the firm. 7. Per the "Tax Cuts and Jobs Act" that went into effect on January 1, 2018, corporations are now taxed at a flat 21% rate. 8. "Interest Expense" which a corporation pays to lenders for outstanding debt financing is tax-deductible on the corporation's tax retum. 9. Over long periods of time, returns from internationally-diversified portfolios tend to be inferior to portfolios consisting of domestic-only securities. 10. A good portion of a portfolio's risk can be eliminated by holding very few or even only one stock in the portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts