Question: its true and false A. TRUE / FALSE QUESTIONS Enter True or False on the blank preceding each question. T 1. Financial Services is the

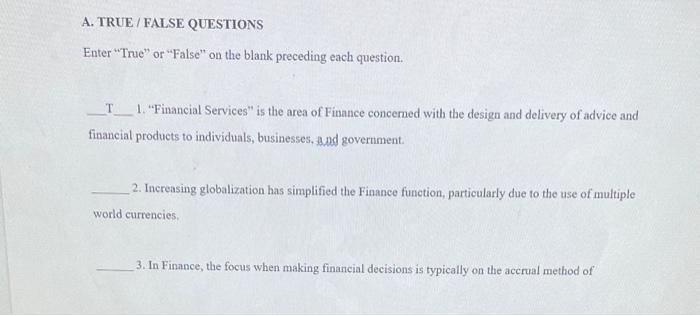

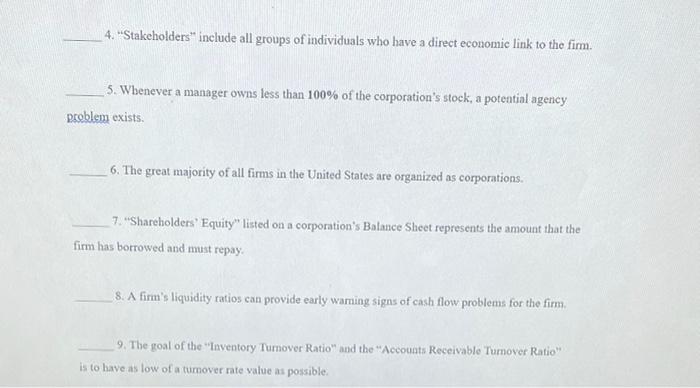

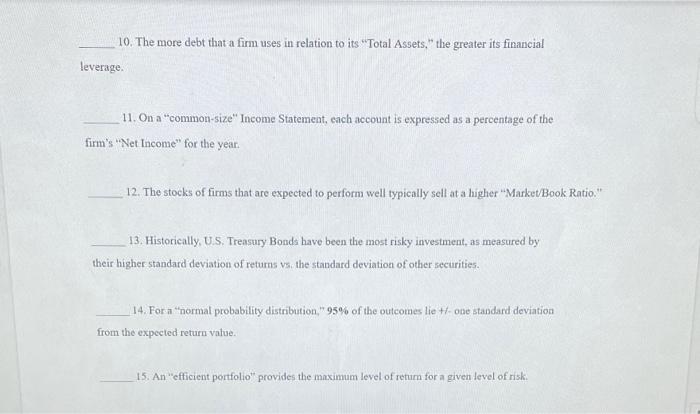

A. TRUE / FALSE QUESTIONS Enter "True" or "False" on the blank preceding each question. T 1. "Financial Services" is the area of Finance concerned with the design and delivery of advice and financial products to individuals, businesses, and government. 2. Increasing globalization has simplified the Finance function, particularly due to the use of multiple world currencies 3. In Finance, the focus when making financial decisions is typically on the accrual method of 4. "Stakeholders include all groups of individuals who have a direct economic link to the firm. 5. Whenever a manager owns less than 100% of the corporation's stock, a potential agency problem exists. 6. The great majority of all firms in the United States are organized as corporations. 7. "Shareholders' Equity" listed on a corporation's Balance Sheet represents the amount that the firm has borrowed and must repay 8. A firm's liquidity ratios can provide early warning signs of cash flow problems for the fimm 9. The goal of the "Inventory Turnover Ratio" and the "Accounts Receivable Tumover Ratio" is to have as low of a tumover rate value as possible 10. The more debt that a firm uses in relation to its "Total Assets, the greater its financial leverage. 11. On a "common-size" Income Statement, cach account is expressed as a percentage of the firm's "Net Income" for the year. 12. The stocks of firms that are expected to perform well typically sell at a higher "Market Book Ratio." 13. Historically, U.S. Treasury Bonds have been the most risky investment, as measured by their higher standard deviation of returns vs. the standard deviation of other securities. 14. For a "normal probability distribution" 95% of the outcomes lie +-one standard deviation from the expected return value. 15. An "efficient portfolio" provides the maximum level of retum for a given level of nisk. 16. Over long periods of time, the retums earned on internationally-diversified portfolios tend to be superior to returns on portfolios that contain only domestic (i.e. one country) investments

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts