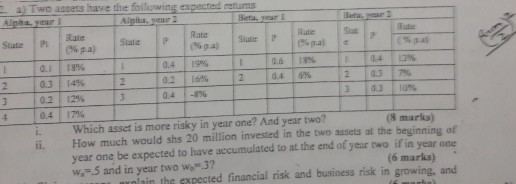

Question: a) Two assets have the following expected returns Alpha. yearl Upha, year2 Beta year E leta, year2 Siat lute State PRate State p Rate 0%

a) Two assets have the following expected returns Alpha. yearl Upha, year2 Beta year E leta, year2 Siat lute State PRate State p Rate 0% pa) 0% pa) 0.1 13% 0.3 | 14% 0.2 12% 04 | 17% . Which asset is more risky in year one? And year two? ii. How much would shs 20 million invested in the two assets at the beginning of 0.4 | 19% |1 | 1 0.4 0.4 169% 0.3 17% 0.4 |-8% (8 marlis) year one be expected to have accumulated to at the end of year two if in year one (6 marks) . w..5 and in year two w-3? in thi expected financial risk and business risk in growing, and

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock