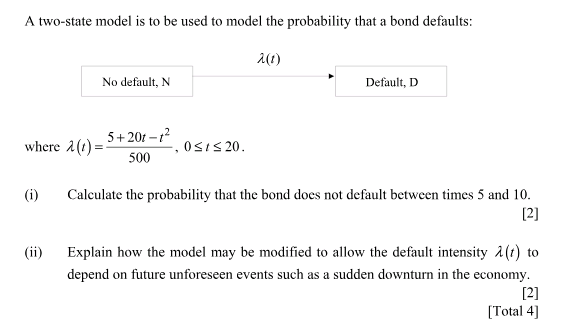

Question: A two-state model is to be used to model the probability that a bond defaults: No default, N Default, D 5+201-72 where A (() =

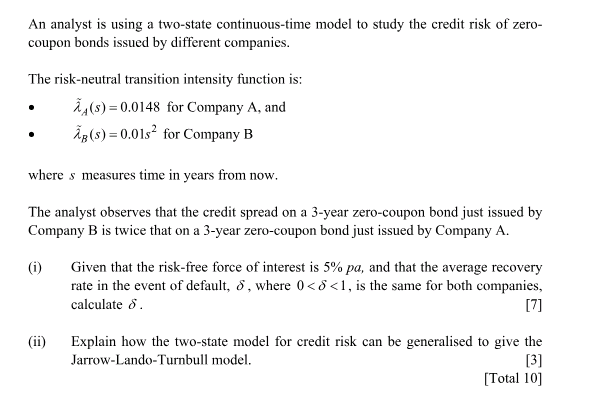

A two-state model is to be used to model the probability that a bond defaults: No default, N Default, D 5+201-72 where A (() = . OSIS 20. 500 (i) Calculate the probability that the bond does not default between times 5 and 10. [2] (ii) Explain how the model may be modified to allow the default intensity 1() to depend on future unforeseen events such as a sudden downturn in the economy. [2] [Total 4]An analyst is using a two-state continuous-time model to study the credit risk of zero- coupon bonds issued by different companies. The risk-neutral transition intensity function is: . A (s) =0.0148 for Company A, and Ag(s) =0.01s for Company B where s measures time in years from now. The analyst observes that the credit spread on a 3-year zero-coupon bond just issued by Company B is twice that on a 3-year zero-coupon bond just issued by Company A. (i) Given that the risk-free force of interest is 5% pa, and that the average recovery rate in the event of default, 6, where 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts