Question: A | U E | 4 2 | 4 2 | S E | S A | 9 L | S A | 9 L

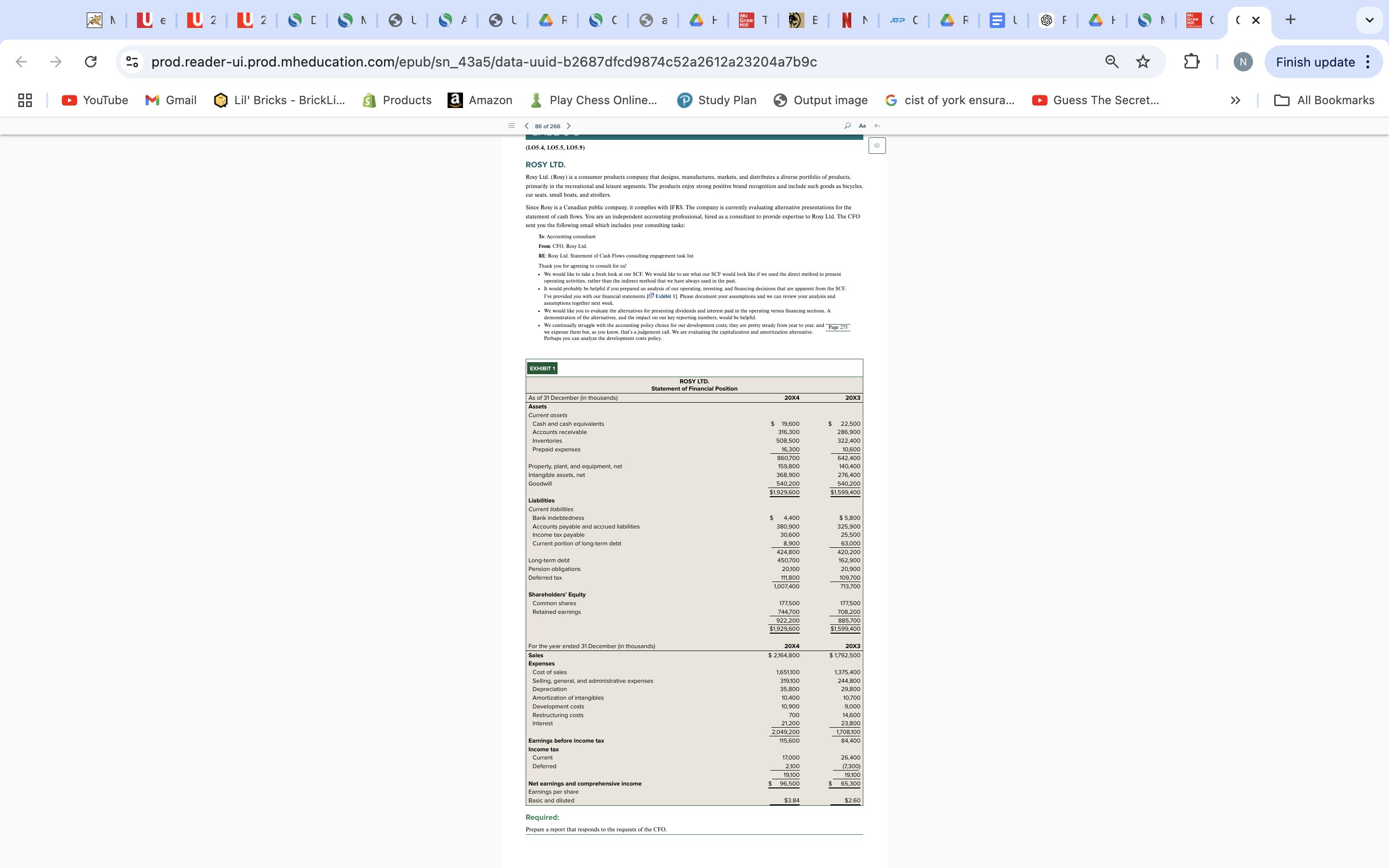

A | U E | 4 2 | 4 2 | S E | S A | 9 L | S A | 9 L | A R | S C | 3 2 | At TEN APCAREISFA SNSC (X G go prod.reader-ui.prod.mheducation.com/epub/sn_43a5/data-uuid-b2687dfcd9874c52a2612a23204a7b9c N Finish update : YouTube M Gmail Lil' Bricks - BrickLi... s Products a Amazon Play Chess Online... Study Plan Output image G cist of york ensura... Guess The Secret... > > All Bookmarks (LOS.4, LO5.5, LO5.9) ROSY LTD. Rosy Lid. (Rosy) is a consumer products company that designs, manufactures, markets, and distributes a diverse portfolio of products, primarily in the recreational and leisure segments TH leisure segments. The products enjoy strong positive brand recognition and include such goods as bicycles, car seats, small boats, and strollers. Since Rosy is a Canadian public company, it complies with IFRS. The company is currently evaluating alternative presentations for the statement of cash flows. You are an independent accounting professional, hired as a consultant to provide expertise to Rosy Lid. The CFO sent you the following email which includes your consulting tasks: To: Accounting consultant From: CFO, Rosy Lid. RE: Rosy Lid. Statement of Cash Flows co culting engagement task list Thank you for agreeing to consult for us! operating activities, rather than the indirect method that we have always used in the past. what our SCF would look like if we used the direct method to present It would probably be helpful if you prepared an analysis of our operating, investing, and financing decisions that are apparent from the SCF. I've provided you with our financial statements [() Exhibit 1). Please document your assumptions and we can review your analysis and we would like you to evaluate the alternatives for presenting dividends and interest paid in the operating versus financing sections. A demonstration of the alternatives, and the impact on our key reporting numbers, would be helpful. We continually struggle with the accounting policy choice for our development costs; they are pretty steady from year to year, and Page 275 Perhaps you can analyze the development costs policy . EXHIBIT ROSY LTD. Statement of Financial Position As of 31 December (in thousands) Assets 20X4 Current assets Cash and cash equivalents Accounts receivable $ 19,600 Inventories 316,300 508,500 Prepaid expenses 16,300 10,600 860,700 642,400 Property, plant, and equipment, net 159,800 140 400 Intangible assets, net Goodwill 368,900 276 400 540,200 $1,929,600 $1,599,400 Liabilities Current liabilities Bank indebtedness Accounts payable and accrued liabilities $ 4 $ 5,80 80,900 325,900 Income tax payable 30,600 25,500 Current portion of long-term debt 8,900 63,000 Long-term debt 450,700 420 Pension obligations 162,900 Deferred tax 20,100 20,900 111,800 109,700 007,400 713.700 Shareholders' Equity Common shares 177,500 Retained earnings 177,500 744,700 708,200 922,200 885,700 $1,929,600 $1,599,400 For the year ended 31 December (in thousands) 20X4 Sales 20X3 2,164,800 $ 1,792,500 Expenses Cost of sales 1,651,100 Selling, general, and administrative expenses Depreciation 319,100 Amortization of intangibles 35,800 244,800 29,800 10,400 10,700 Development costs 10,900 Restructuring costs Interest 700 14,600 21,200 23.800 1,708.100 Earnings before income tax Income tax 115,600 84,400 Canrent Deferred 12000 26,400 2,100 (7,300) Net earnings and comprehensive income 19.100 19.100 96,50 $ 65,300 Basic and diluted $3.84 $2.60 Required: Prepare a report that responds to the requests of the CFO

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts