Question: A U.S-based MNC has a subsidiary in China where the local currency is the Renminbi (RMB). The balance sheets and income statements of the subsidiary

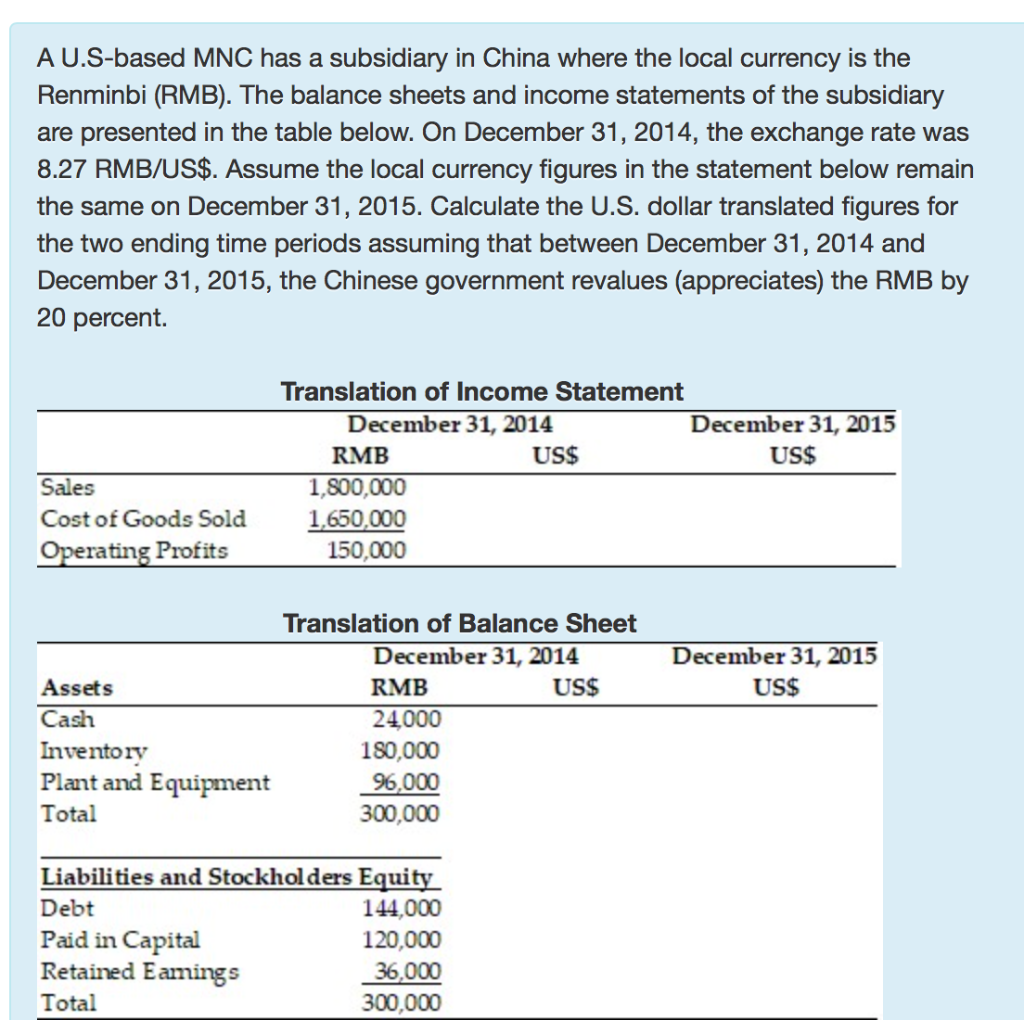

A U.S-based MNC has a subsidiary in China where the local currency is the Renminbi (RMB). The balance sheets and income statements of the subsidiary are presented in the table below. On December 31, 2014, the exchange rate was 8.27 RMB/US$. Assume the local currency figures in the statement below remain the same on December 31, 2015. Calculate the U.S. dollar translated figures for the two ending time periods assuming that between December 31, 2014 and December 31, 2015, the Chinese government revalues (appreciates) the RMB by 20 percent. Translation of Income Statement December 31, 2014 December 31, 2015 RMB US$ US$ 1,800,000 1,650,000 150,000 Sales Cost of Goods Sold Operating Profits December 31, 2015 US$ Translation of Balance Sheet December 31, 2014 Assets RMB US$ Cash 24,000 Inventory 180,000 Plant and Equipment 96,000 Total 300,000 Liabilities and Stockholders Equity Debt 144,000 Paid in Capital 120,000 Retained Eamings 36,000 Total 300,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts