Question: a. Use the Black-Scholes formula to find the value of the following call option. (Do not round intermediate calculations. Round your final answer to 2

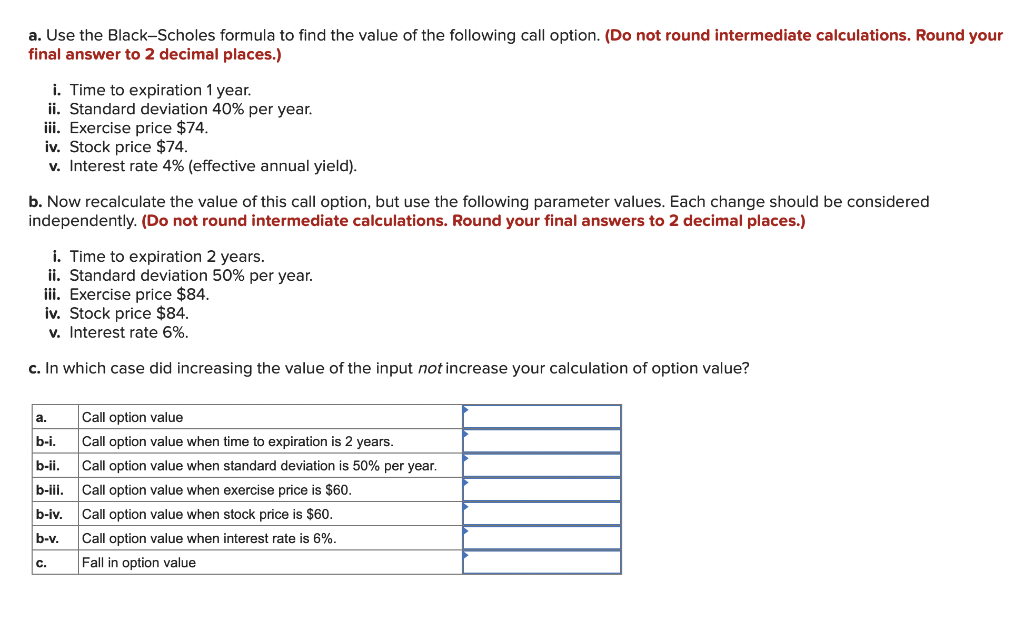

a. Use the Black-Scholes formula to find the value of the following call option. (Do not round intermediate calculations. Round your final answer to 2 decimal places.) i. Time to expiration 1 year. ii. Standard deviation 40% per year. iii. Exercise price $74. iv. Stock price $74. v. Interest rate 4% (effective annual yield). b. Now recalculate the value of this call option, but use the following parameter values. Each change should be considered independently. (Do not round intermediate calculations. Round your final answers to 2 decimal places.) i. Time to expiration 2 years. ii. Standard deviation 50% per year. iii. Exercise price $84. iv. Stock price $84. V. Interest rate 6%. c. In which case did increasing the value of the input not increase your calculation of option value? a. b-i. b-ii. b-ill. Call option value Call option value when time to expiration is 2 years. Call option value when standard deviation is 50% per year. Call option value when exercise price is $60. Call option value when stock price is $60. Call option value when interest rate is 6%. Fall in option value b-iv. b-v. c

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts