Question: a. Use the data given to calculate annual returns for Goodman, Landry, and the Market Index, and then Data as given in the problem are

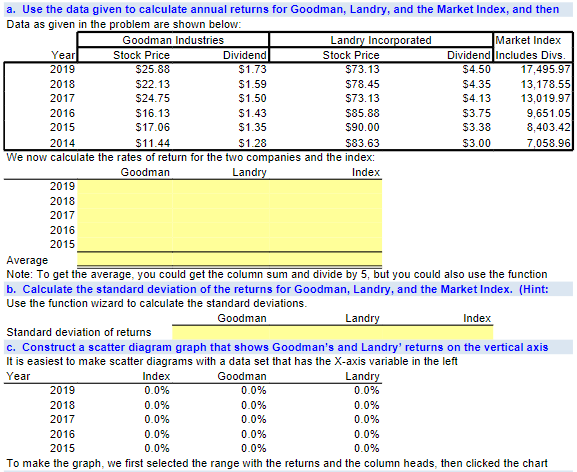

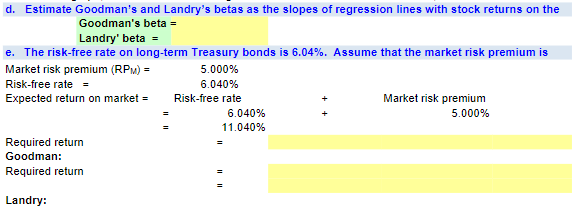

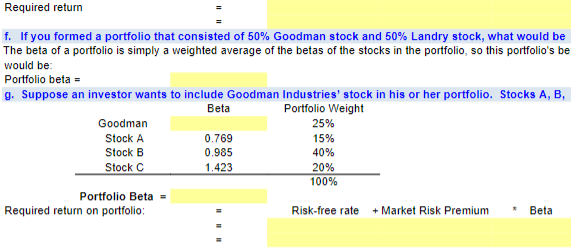

a. Use the data given to calculate annual returns for Goodman, Landry, and the Market Index, and then Data as given in the problem are shown below: Goodman Industries Landry Incorporated Market Index Year Stock Price Dividend Stock Price Dividend Includes Divs. 2019 $25.88 $1.73 $73.13 $4.50 17,495.97 2018 $22.13 $1.59 $78.45 $4.35 13,178.55 2017 $24.75 $1.50 S73.13 $4.13 13,019.97 2016 $16.13 $1.43 $85.88 $3.75 9.651.05 2015 $17.06 $1.35 $90.00 $3.38 8,403.42 2014 $11.44 $1.28 $83.63 $3.00 7.058.96 We now calculate the rates of return for the two companies and the index: Goodman Landry Index 2019 2018 2017 2016 2015 Average Note: To get the average, you could get the column sum and divide by 5, but you could also use the function b. Calculate the standard deviation of the returns for Goodman, Landry, and the Market Index. (Hint: Use the function wizard to calculate the standard deviations Goodman Landry Index Standard deviation of returns c. Construct a scatter diagram graph that shows Goodman's and Landry' returns on the vertical axis It is easiest to make scatter diagrams with a data set that has the X-axis variable in the left Year Index Goodman Landry 2019 0.0% 0.0% 0.0% 2018 0.0% 0.0% 0.0% 2017 0.0% 0.0% 0.0% 2016 0.0% 0.0% 0.0% 2015 0.0% 0.0% 0.0% To make the graph, we first selected the range with the returns and the column heads, then clicked the chart d. Estimate Goodman's and Landry's betas as the slopes of regression lines with stock returns on the Goodman's beta = Landry' beta = e. The risk-free rate on long-term Treasury bonds is 6.04%. Assume that the market risk premium is Market risk premium (RPM) = 5.000% Risk-free rate = 6.040% Expected return on market = Risk-free rate Market risk premium 6.040% + 5.000% 11.040% Required return Goodman: Required return Landry: Required return f. If you formed a portfolio that consisted of 50% Goodman stock and 50% Landry stock, what would be The beta of a portfolio is simply a weighted average of the betas of the stocks in the portfolio, so this portfolio's be would be: Portfolio beta = g. Suppose an investor wants to include Goodman Industries' stock in his or her portfolio. Stocks A, B, Beta Portfolio Weight Goodman 25% Stock A 0.769 15% Stock B 0.985 40% Stock C 1.423 20% 100% Portfolio Beta = Required return on portfolio Risk-free rate + Market Risk Premium Beta a. Use the data given to calculate annual returns for Goodman, Landry, and the Market Index, and then Data as given in the problem are shown below: Goodman Industries Landry Incorporated Market Index Year Stock Price Dividend Stock Price Dividend Includes Divs. 2019 $25.88 $1.73 $73.13 $4.50 17,495.97 2018 $22.13 $1.59 $78.45 $4.35 13,178.55 2017 $24.75 $1.50 S73.13 $4.13 13,019.97 2016 $16.13 $1.43 $85.88 $3.75 9.651.05 2015 $17.06 $1.35 $90.00 $3.38 8,403.42 2014 $11.44 $1.28 $83.63 $3.00 7.058.96 We now calculate the rates of return for the two companies and the index: Goodman Landry Index 2019 2018 2017 2016 2015 Average Note: To get the average, you could get the column sum and divide by 5, but you could also use the function b. Calculate the standard deviation of the returns for Goodman, Landry, and the Market Index. (Hint: Use the function wizard to calculate the standard deviations Goodman Landry Index Standard deviation of returns c. Construct a scatter diagram graph that shows Goodman's and Landry' returns on the vertical axis It is easiest to make scatter diagrams with a data set that has the X-axis variable in the left Year Index Goodman Landry 2019 0.0% 0.0% 0.0% 2018 0.0% 0.0% 0.0% 2017 0.0% 0.0% 0.0% 2016 0.0% 0.0% 0.0% 2015 0.0% 0.0% 0.0% To make the graph, we first selected the range with the returns and the column heads, then clicked the chart d. Estimate Goodman's and Landry's betas as the slopes of regression lines with stock returns on the Goodman's beta = Landry' beta = e. The risk-free rate on long-term Treasury bonds is 6.04%. Assume that the market risk premium is Market risk premium (RPM) = 5.000% Risk-free rate = 6.040% Expected return on market = Risk-free rate Market risk premium 6.040% + 5.000% 11.040% Required return Goodman: Required return Landry: Required return f. If you formed a portfolio that consisted of 50% Goodman stock and 50% Landry stock, what would be The beta of a portfolio is simply a weighted average of the betas of the stocks in the portfolio, so this portfolio's be would be: Portfolio beta = g. Suppose an investor wants to include Goodman Industries' stock in his or her portfolio. Stocks A, B, Beta Portfolio Weight Goodman 25% Stock A 0.769 15% Stock B 0.985 40% Stock C 1.423 20% 100% Portfolio Beta = Required return on portfolio Risk-free rate + Market Risk Premium Beta

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts