Question: a. Using the data provided in problem 3, determine the return and risk for a portfolio made up of the following three stocks if you

a. Using the data provided in problem 3, determine the return and risk for a portfolio made up of the following three stocks if you want to distribute your investment as follows: 20% in ADRE; 65% in MSFT and 15% in GOOG. b. How would the portfolio be affected if you distributed your investment in the following way: 30% in ADRE; 25% on MSFT and 45% on GOOG? c. Which of the two portfolios would a risk seeking investor prefer and why?

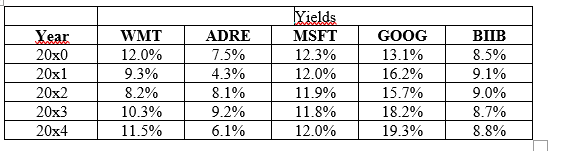

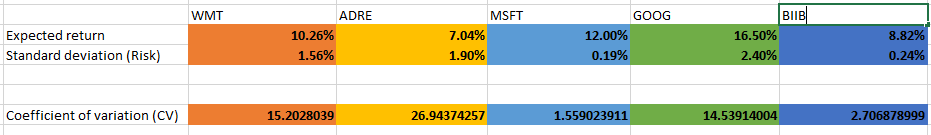

Year 20x0 20x1 20x2 20x3 20x4 WMT 12.0% 9.3% 8.2% 10.3% 11.5% ADRE 7.5% 4.3% 8.1% 9.2% 6.1% Yields MSFT 12.3% 12.0% 11.9% 11.8% 12.0% GOOG 13.1% 16.2% 15.7% 18.2% 19.3% BIIB 8.5% 9.1% 9.0% 8.7% 8.8% WMT BIIB Expected return Standard deviation (Risk) ADRE 10.26% 1.56% MSFT 7.04% 1.90% GOOG 12.00% 0.19% 16.50% 2.40% 8.82% 0.24% Coefficient of variation (CV) 15.2028039 26.94374257 1.559023911 14.53914004 2.706878999 Year 20x0 20x1 20x2 20x3 20x4 WMT 12.0% 9.3% 8.2% 10.3% 11.5% ADRE 7.5% 4.3% 8.1% 9.2% 6.1% Yields MSFT 12.3% 12.0% 11.9% 11.8% 12.0% GOOG 13.1% 16.2% 15.7% 18.2% 19.3% BIIB 8.5% 9.1% 9.0% 8.7% 8.8% WMT BIIB Expected return Standard deviation (Risk) ADRE 10.26% 1.56% MSFT 7.04% 1.90% GOOG 12.00% 0.19% 16.50% 2.40% 8.82% 0.24% Coefficient of variation (CV) 15.2028039 26.94374257 1.559023911 14.53914004 2.706878999

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts