Question: Problem 3: The annual returns for five different stocks are presented below. Year 20x0 20x1 20x2 20x3 20x4 WMTADRE 12.0% 7.5% 9.3% 4.3% 8.2% 8.1%

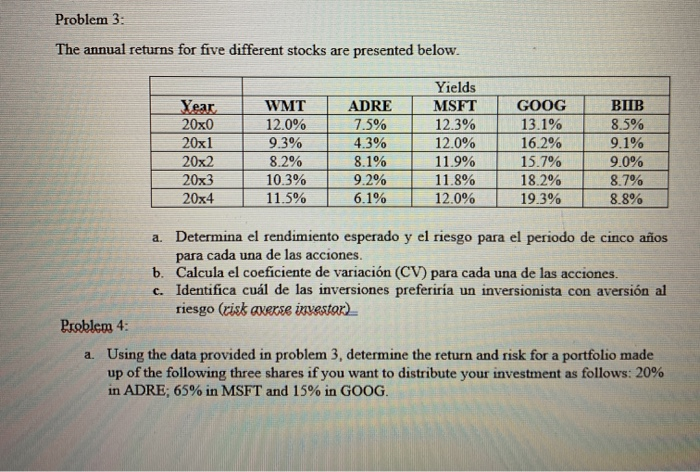

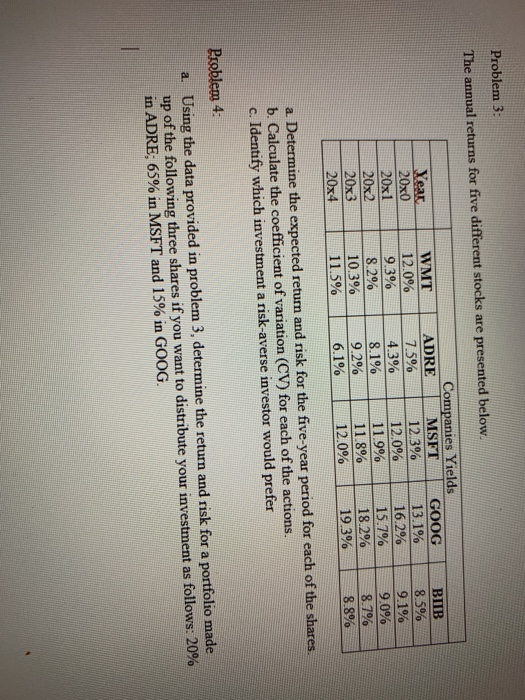

Problem 3: The annual returns for five different stocks are presented below. Year 20x0 20x1 20x2 20x3 20x4 WMTADRE 12.0% 7.5% 9.3% 4.3% 8.2% 8.1% 10.3% 9.2% 11.5% 6.1% Yields MSFT 12.3% 12.0% 11.9% 11.8% 12.0% GOOG 13.1% 16.2% 15.7% 18.2% 19.3% BIIB 8.5% 9.1% 9.0% 8.7% 8.8% a. Determina el rendimiento esperado y el riesgo para el periodo de cinco aos para cada una de las acciones. b. Calcula el coeficiente de variacin (CV) para cada una de las acciones. c. Identifica cul de las inversiones preferira un inversionista con aversin al riesgo (risk averse investor) Problem 4: a. Using the data provided in problem 3, determine the return and risk for a portfolio made up of the following three shares if you want to distribute your investment as follows: 20% in ADRE; 65% in MSFT and 15% in GOOG. Problem 3 The annual returns for five different stocks are presented below. Companies Yields WMT ADRE MSFT. Year GOOG 12.0% 12.3% 7.5% 20x0 13.1% 16.2% 12.0% 20x1 9.3% 4.3% 119% 15.7% 20x2 8.1% 8.2% 18.2% 20x3 10.3% 11.8% 9.2% 20x4 19.3% 6.1% 11.5% 12.0% BIIB 8.5% 9.1% 9.0% 8.7% 8.8% a. Determine the expected return and risk for the five-year period for each of the shares. b. Calculate the coefficient of variation (CV) for each of the actions. c. Identify which investment a risk-averse investor would prefer Problem 4: a. Using the data provided in problem 3, determine the return and risk for a portfolio made up of the following three shares if you want to distribute your investment as follows: 20% in ADRE; 65% in MSFT and 15% in GOOG

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts