Question: (A) Using the Dividend Discount Model Step 1: Find the discount rate: Following industry practice when apply the CAPM model; we will use Treasury

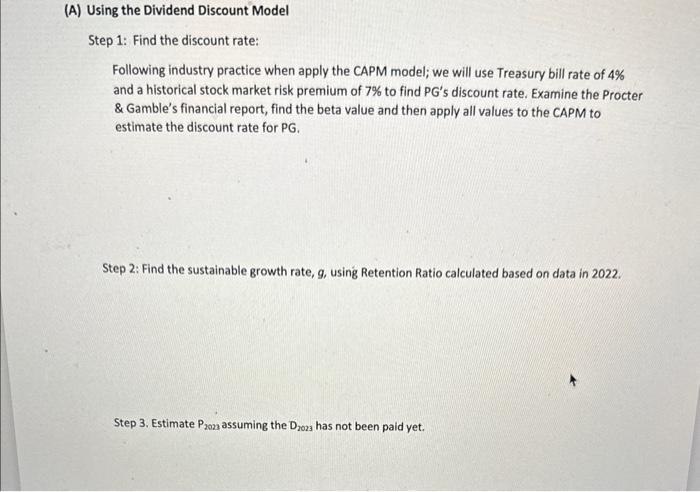

(A) Using the Dividend Discount Model Step 1: Find the discount rate: Following industry practice when apply the CAPM model; we will use Treasury bill rate of 4% and a historical stock market risk premium of 7% to find PG's discount rate. Examine the Procter & Gamble's financial report, find the beta value and then apply all values to the CAPM to estimate the discount rate for PG. Step 2: Find the sustainable growth rate, g, using Retention Ratio calculated based on data in 2022. Step 3. Estimate P2023 assuming the D2023 has not been paid yet.

Step by Step Solution

3.51 Rating (158 Votes )

There are 3 Steps involved in it

Step 1 Find the discount rate using the Capital Asset Pricing Model CAPM The CAPM formula is Expected Return RiskFree Rate Beta Market Risk Premium As... View full answer

Get step-by-step solutions from verified subject matter experts